Not yet a paid subscriber to Herb on the Street and my Red Flag Alerts? Join the growing club of investors who want to avoid the biggest mistake investors make…Find out more and how to subscribe right here.

▶Let’s just say this one was too obvious and easy – a classic pump-and-dump of the worst kind...

A mere two weeks ago I wrote “Stock Promotion On Steroids,” with the focus on nonsensical trading in the Nasdaq-traded*** Ostin Technology ($OST), a China-based tech stock that I said should trade for pennies.You can read the full report here. I’ve dropped the paywall.

(***It trades on the Nasdaq’s come-one, come-all version of the Vancouver Stock Exchange. Most investors don’t know the difference between the real Nasdaq and this one. Why the Nasdaq is enabling these scams is baffling, but I digress...)

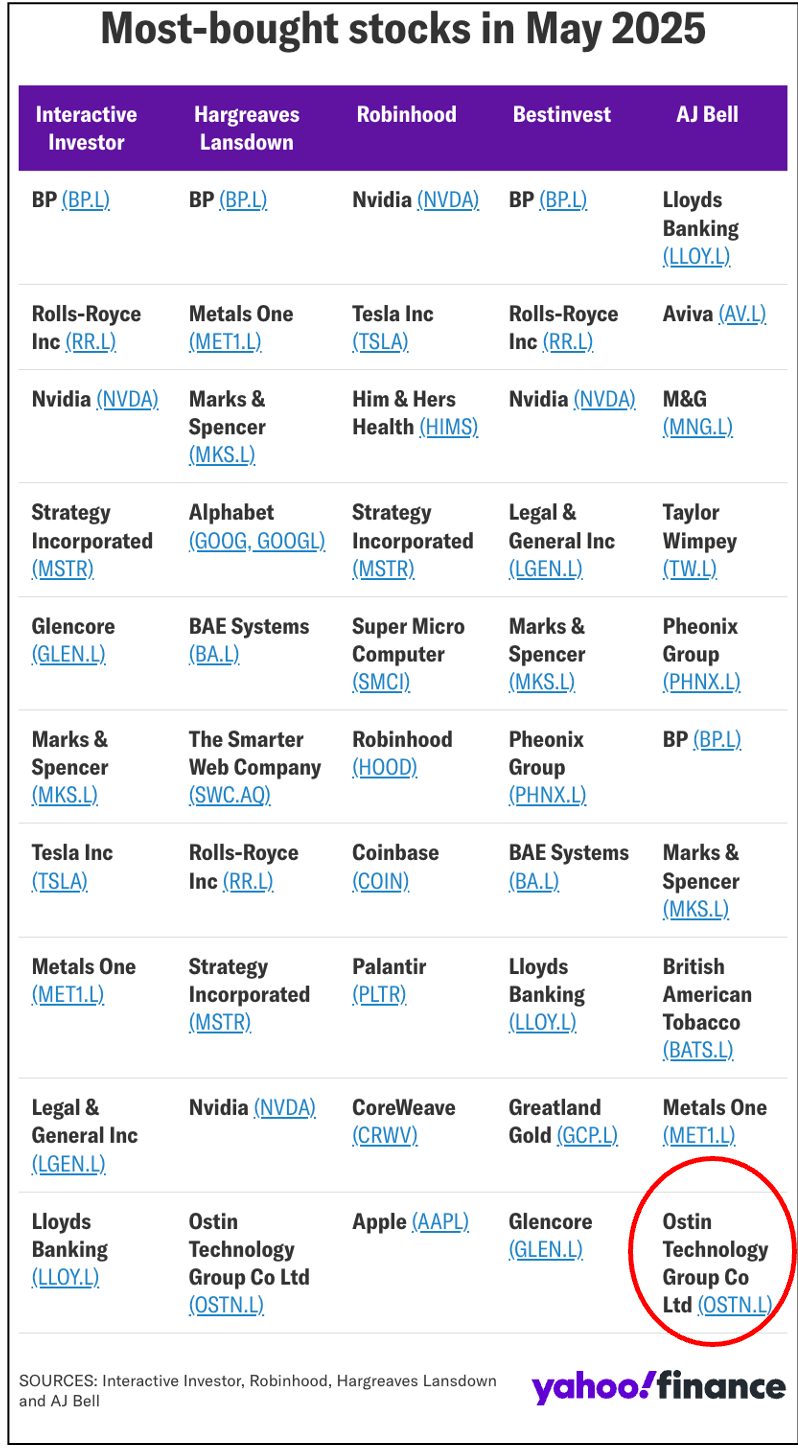

Most Popular Stock

Ostin, like others of its ilk, had quite a few elements that make it the perfect scam: It appeared to make a real product. It traded a ridiculous number of shares every day.

Heck, it even showed up on Yahoo Finance as among the “most popular stocks in May”...

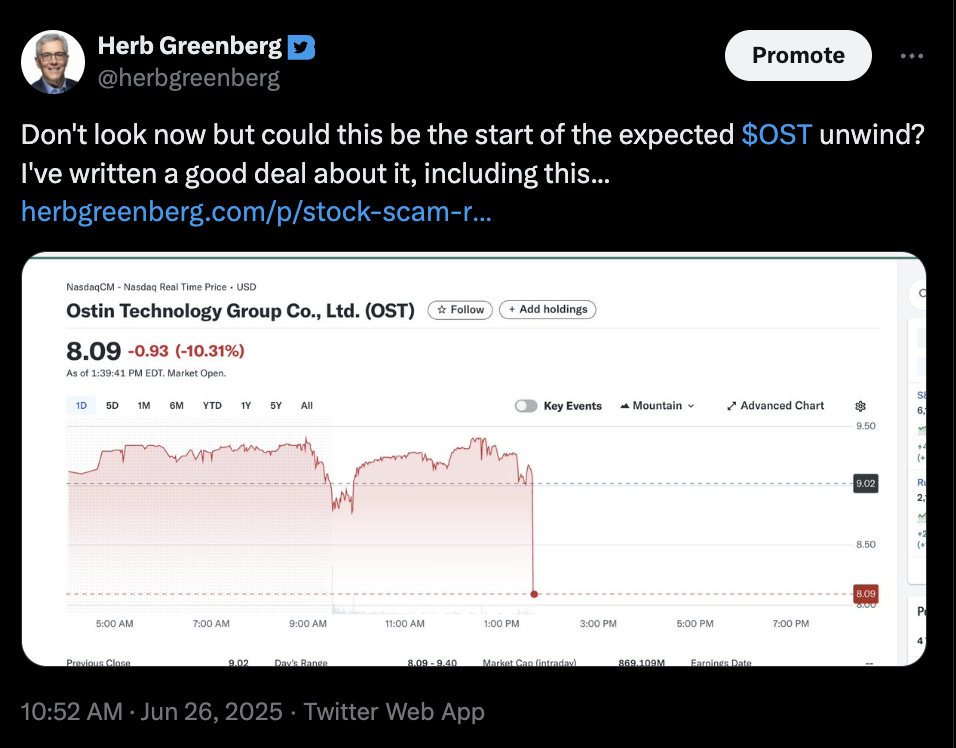

When I first wrote about it, the stock was trading for around $7, ratcheting higher daily. Yesterday morning I just happened to check, and saw it had spiked above $9. I shook my head and texted a few friends who had been expecting the stock to implode, saying, “OST makes zero sense.”

And then... no more than an hour later one of them texted me back, saying, “This may be the rug-pull here.”

I had no idea what he was talking about, so I checked the stock and there it was – down 10%... in an instant. That led me to post on social media...

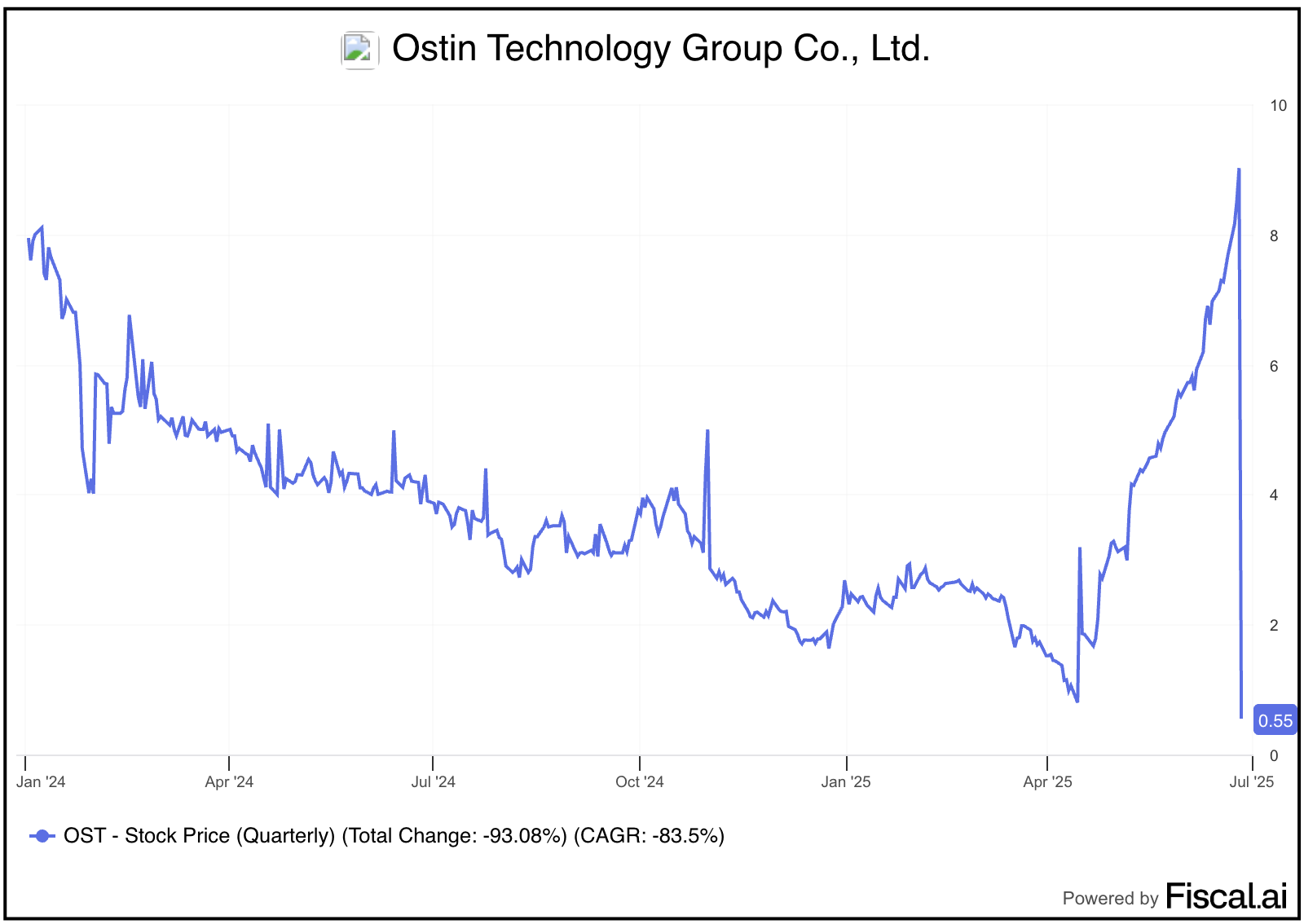

Little did I know, this wasn’t just the rug pull, but the foundation was crumbling beneath the whole house! It had to be no more than an hour later that the same friend texted me again, saying... “Boom! That was abrupt.”

Look Out Below...

I looked – the stock was down 95% and by the market’s close, OST shares had plunged to (wait for it!) pennies... as in 57 pennies. As I write this today, it’s more like 32 pennies.

As it turns out, this appears to be straight out of the playbook of the very same China stock scam the Wall Street Journal wrote about the day after my original Ostin report appeared. It’s a scam, usually run out of Asia, that preys on victims using social media and WhatsApp groups... and as I’ve written, Ostin is not an isolated example.

I then rehashed what the Journal wrote in my “Stock Scam Revealed” writeup, but with a focus on Ostin.

Here’s where it gets interesting...

After the stock’s initial 10% tumble yesterday, I heard from the person who first alerted me to the scam. He’s a short-seller who can sniff out a fraud – even if it’s a few continents away. As part of his research, he joined several of these WhatsApp groups... so he could see for himself how it worked.

‘It’s All Made Up’

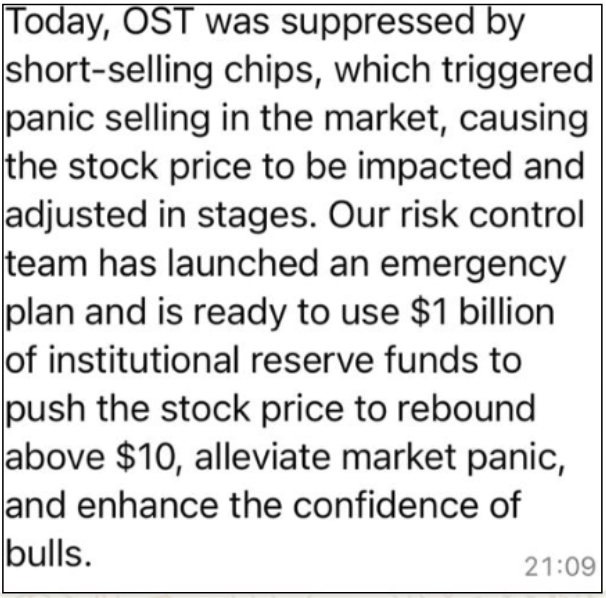

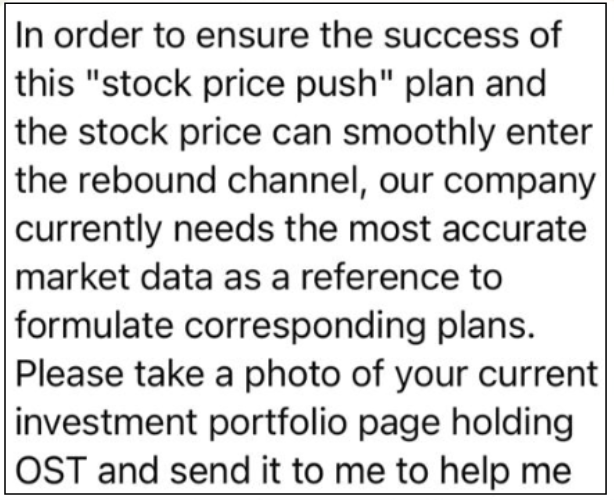

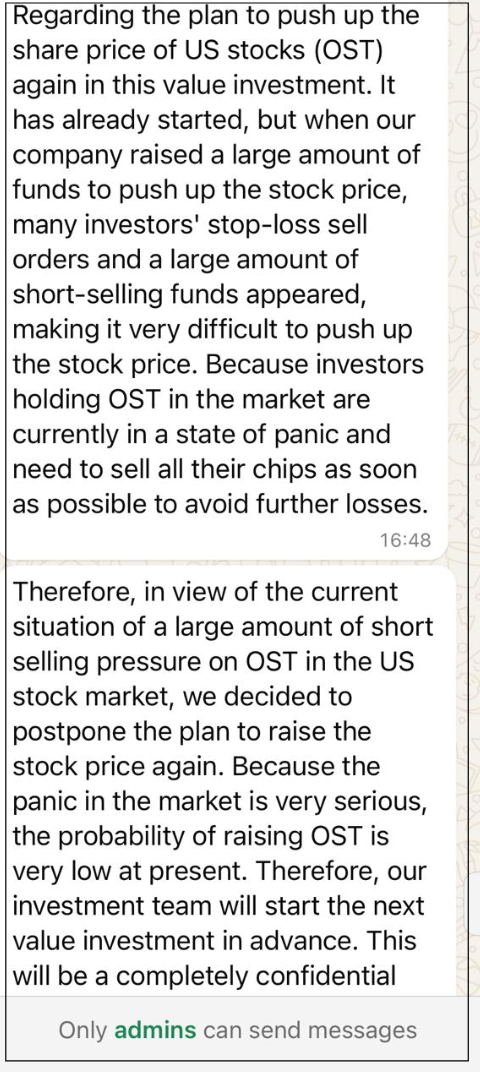

He was surprised by the stock’s drop, because the WhatsApp groups had been advising investors to wait until July 4 to sell. Or that’s what the WhatsApp texts he received said, such as this one, which suggests outright manipulation “to push the stock price to rebound above $10”...

They even have a name for it – the “stock price push plan”...

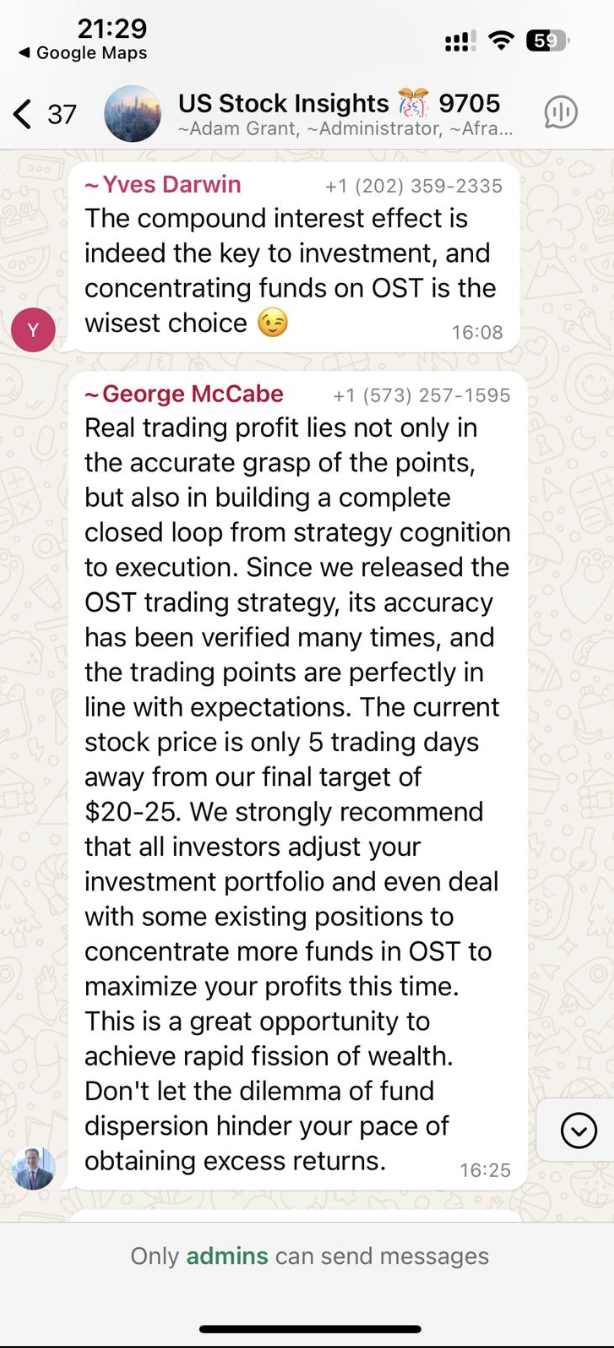

And this one – encouraging investors to send in even more money since “the stock price is only 5 trading days away from our final target of $20-$25.”

Reading some of the phrases riddled throughout these posts, I responded to my friend...

“Rebound channel.” “Stock price push channel.” “Risk control team” - all made up!

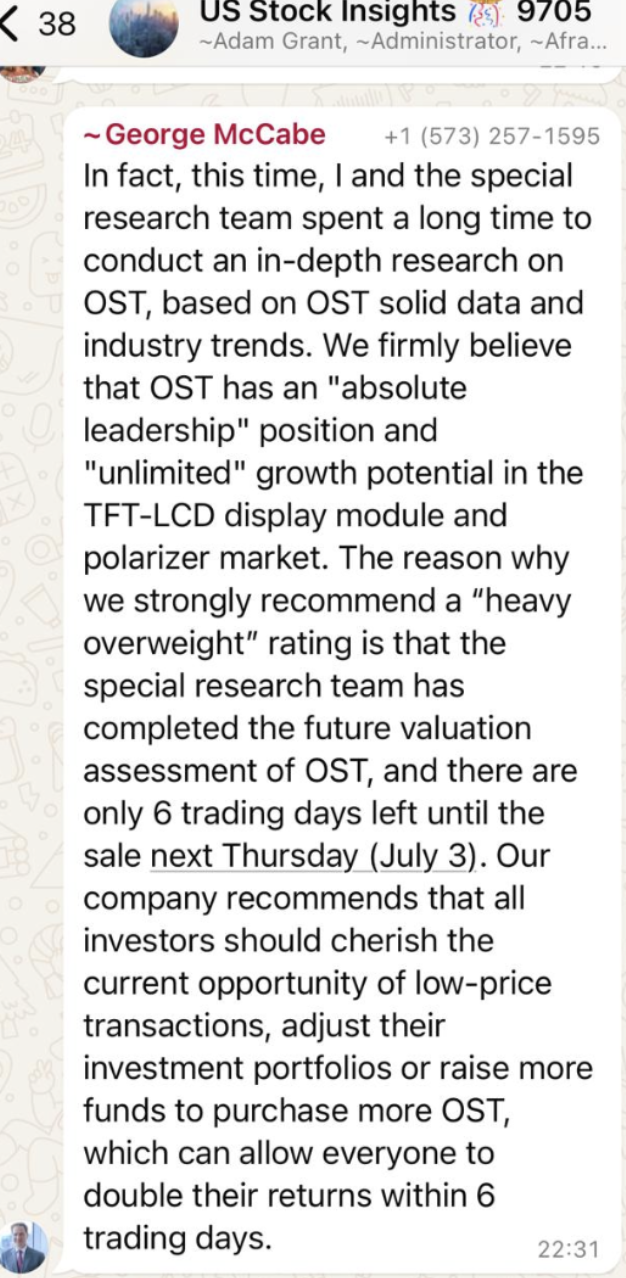

And then there was this additional text, with one final plea for investors “to cherish the current opportunity of low-price transactions, adjust their investment portfolios or raise more funds to purchase more OST, which can allow everyone to double their returns within 6 trading days.”

It gets even worse...

Aided By AI...

I heard from several people from around the world who say they lost considerable amounts of money... some claiming to have lost it all.

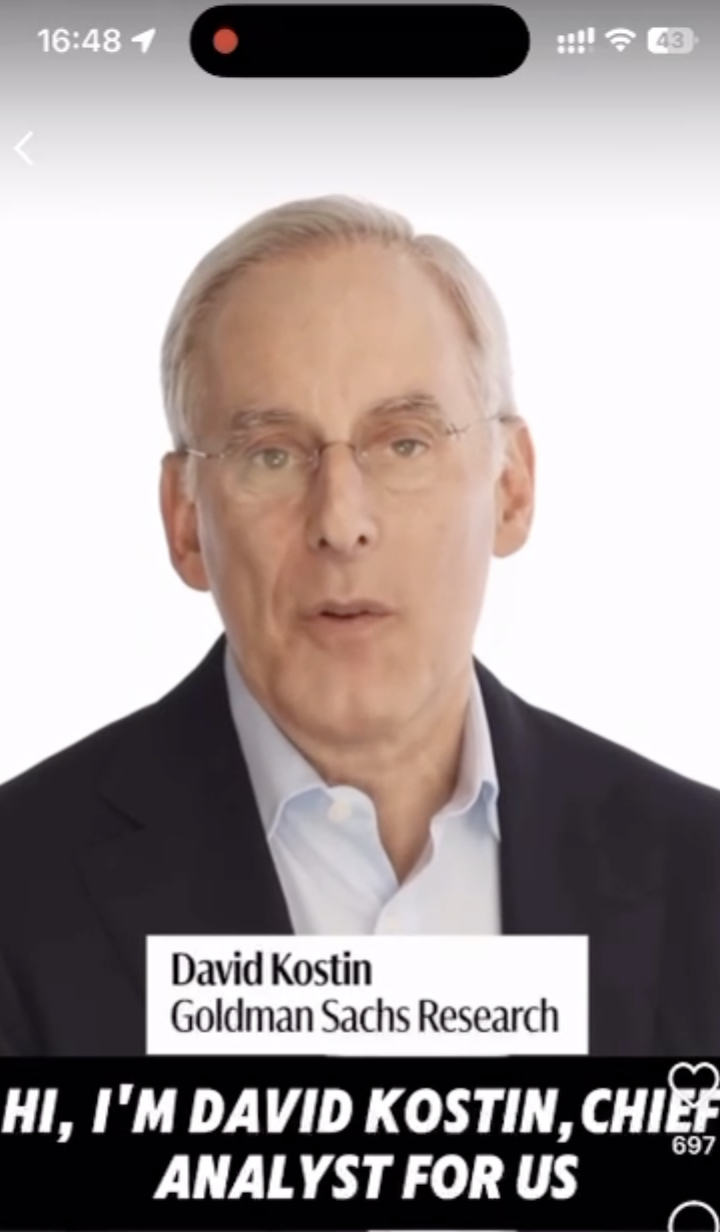

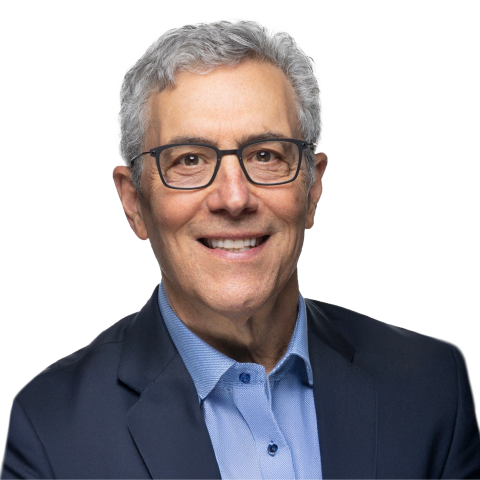

The lure is usually fake AI-created ads on social media using high-profile Wall Street personalities to create the illusion of credibility... like this one used for the Ostin scam featuring Goldman Sachs chief strategist David Kostin...

In this one, Kostin’s AI-created message says, “If you’re interested in missing out on investment opportunities, and want to learn more about quality stocks, you’re welcome to join my WhatsApp group.”

One Ostin investor who claims to have lost $35,000 said he initially made some money on a few stocks – just enough to convince him to invest even more. He showed me texts that claimed that the person he was texting with worked with a firm that is regulated by the SEC and FINRA – claiming what appears to be a legitimate financial planning firm in Manhattan Beach, CA.

In fact, the group the Ostin investor joined uses the name and photo of a principal of that firm as the “site administrator,” with texts also coming from another principal of the firm.

Fake, Fake, Fake

The scamsters even provided contact information, with the second principal's photo directly from the legit website – except when you look closely, the phone number is different from the phone number on the person’s contact real page. (I’m intentionally not using the firm’s name here because I haven’t reached out to them, and I suspect they have no idea they were being used as a ruse.)

When the group member pushed on whether the firm behind the stock had a website – and whether he could meet someone in person, they sent him the URL that appeared to go to the website of the firm the two principals worked at. Except, the scamsters added an “s” to the firm’s name in the URL – and it sent him to a fake replica of the real one...

Here’s the Kicker...

The minute the stock collapsed, “the whole group disappeared,” said my friend who had joined one.” But not to worry, he added, because “they are already setting up their next group.”

He immediately got a text for this...

And this...

There truly is a scam born every minute and now, in this golden age of grift, they’re flourishing.

Postscript…

Ostin today issued a press release saying that it does “not have any undisclosed material matters, nor is it aware of the specific reasons for the abnormal stock price fluctuations on June 26. However, we must caution investors and all other persons to rely solely on statements and filings with the U.S. Securities and Exchange Commission issued by the Company itself or its authorized representatives. The Company does not intend to make further statements regarding this matter.”

To which I say two things: What happened to their stock was hardly what I’d call “abnormal stock fluctuations.” And...funny, they didn’t say anything when the stock was skyrocketing.

Oh, and the scamsters? They put a comment up on WhatsApp blaming the stock’s decline on short-sellers, which if it wasn’t so absurd would be laughable.

The beat goes on...

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com