The company, China-based Ostin Technology ($OST), is incorporated in the Cayman Islands and structured as a variable interest entity, but trades on the Nasdaq Capital Markets, better known as the NasdaqCM. That’s not to be confused with the main Nasdaq; it’s the entry-level Nasdaq, akin to the Vancouver Stock Exchange, where anybody anywhere can list as long as they can pay the fees and meet the loose listing requirements.

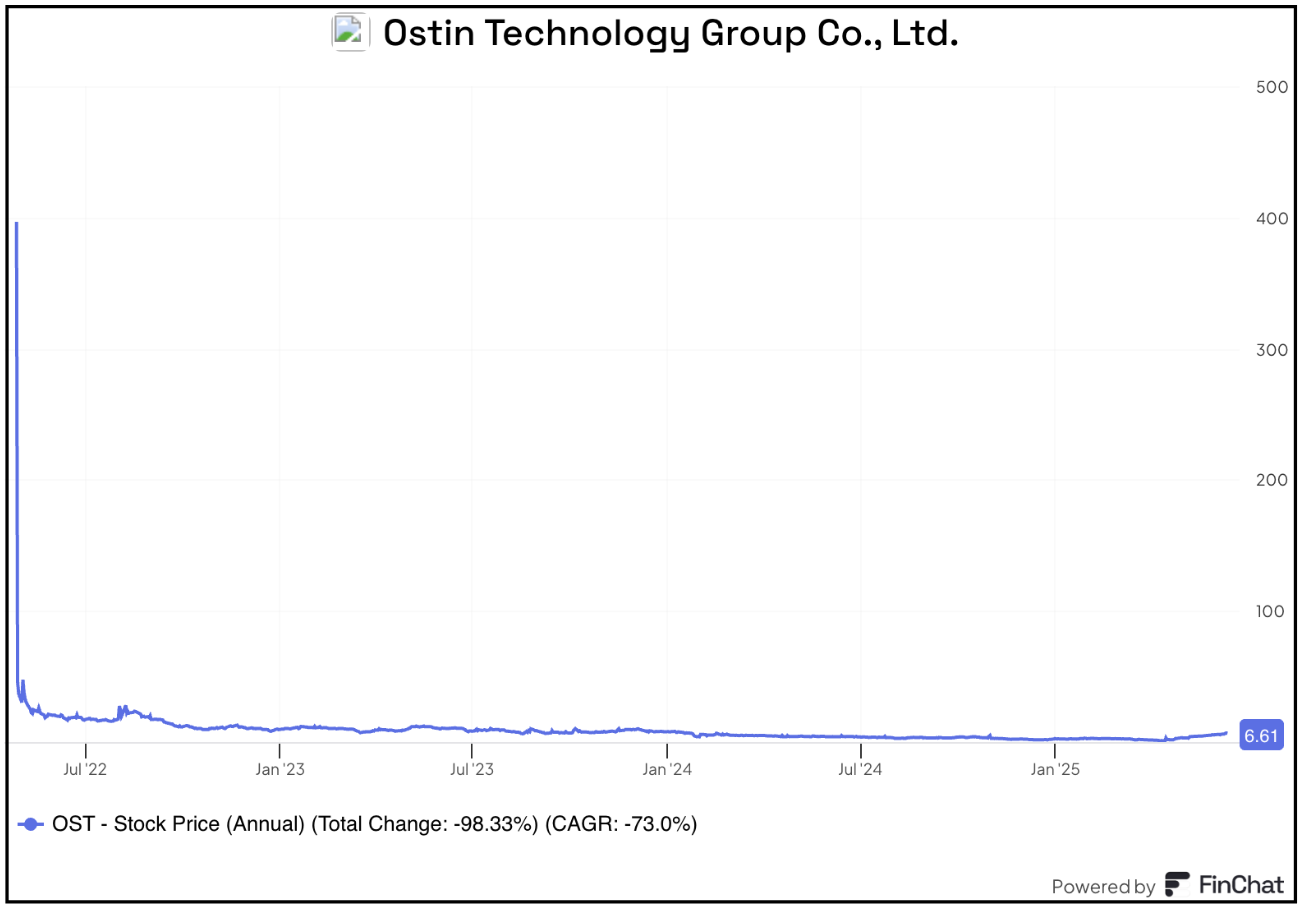

Ostin went public in April 2022 at $4, but made headlines after finishing the day up nearly 900% to close at $35.66. At that point, as Barron’s put it at the time, Ostin “was the best first day pop” for any IPO that year. Then the next day reality hit, when it plunged by more than 88%. As its stock chart shows, it has been a disaster ever since...

Then, in January 2024, Ostin fell out of NasdaqCM compliance after its stock fell below $1 for 30 consecutive trading days. The company was given 180 days – or until the middle of July – to get into compliance. It didn’t, so it was given another 180 days. (Just why it would be given a second extension is itself baffling, but I digress...)

Ostin finally got back into compliance in January, but only after (drumroll!) it did a 1-for-10 reverse stock split...

Boom-to-Burst

But by April 10 its shares sank back to 98 cents, before hitting 80 cents on April 14. Unable to do yet another reverse split, the very next day it did the next best thing: It did an offering for $5 million of stock and warrants for a combined price of 55 cents a share.

Here’s where things start getting interesting...

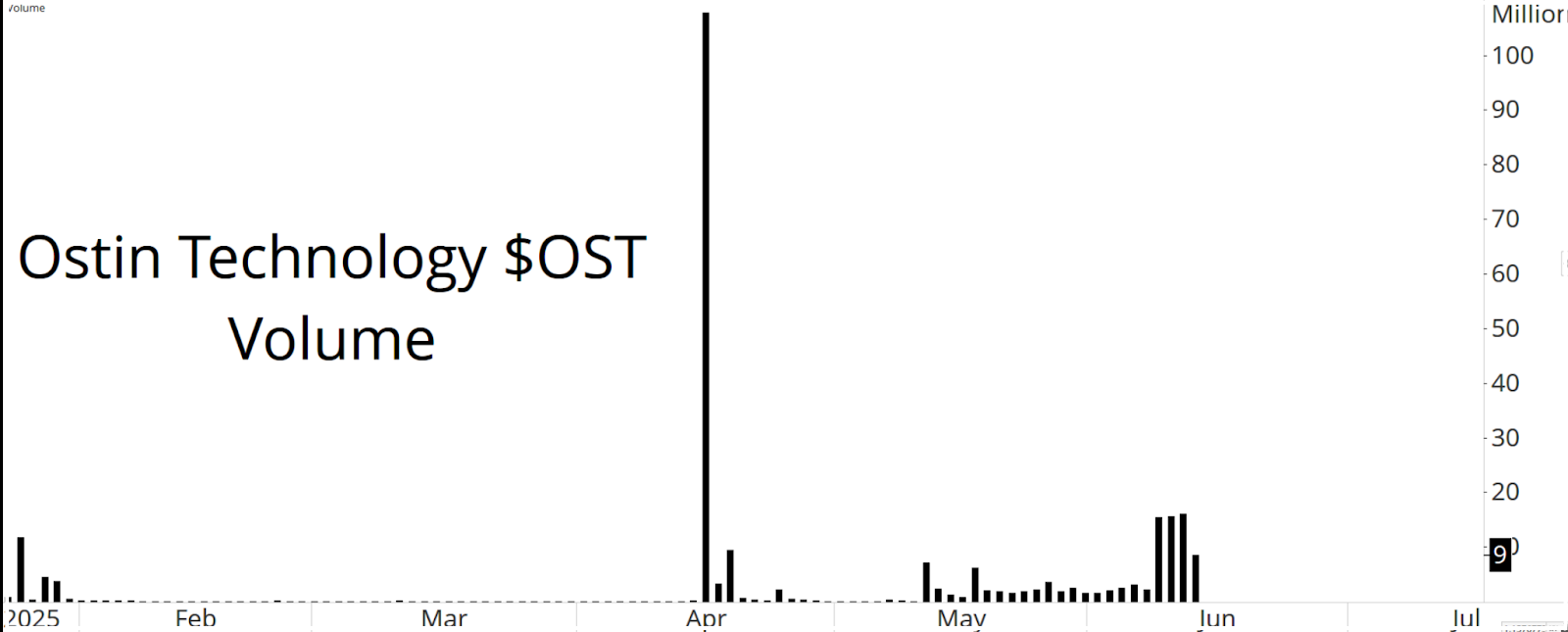

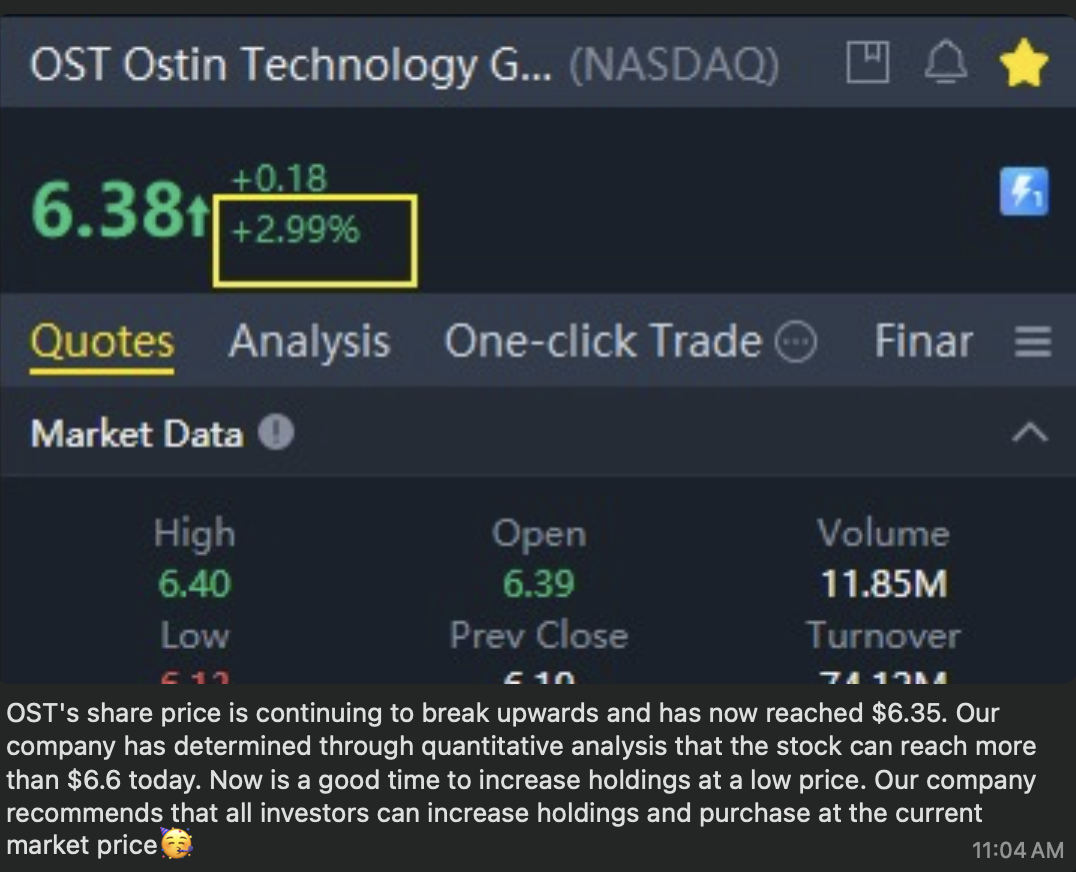

On that same day, in what surely is a mystery, the stock more than tripled on volume of nearly 107 million shares. Since then it’s up nearly 800%.

But even crazier is its trading volume, which for a company with $30 million in revenues as of its last reported financial results – for the year ended September 30 – is nuts!

The reason for the sudden interest, it appears, has nothing to do with Ostin’s fundamentals but everything to do with stock promotion and what appears to be little more than a new-age pump-and-dump.

By new age, here’s what I mean...

These promoters buy ads using AI-generated images and deep fakes of people like Goldman Sachs chief strategist David Kostin, who in one video is seen welcoming people to join “my WhatsApp” group to “learn more about quality stocks.”

These ads appear on the likes of Instagram. One friend who knows a thing or two about stock trading and is exceptional at spotting fraud – and who joined a few of these groups as part of his own investigation – says that based on his observation, they’re “populated with multiple fake accounts. They pretend to talk about stock markets, but their only purpose is to convince the victim to buy OST. They then ask to see the trade tickets to confirm purchases.”

Pig Butchering

His takeaway: “This is a big pump and dump factory run as if it was a pig-butchering scheme.” (Pig-butchering refers to one of the most notorious crypto currency scams. As the U.S. Secret Service explains, it “involve fraudsters gaining the trust of victims, oftentimes via a fictitious romantic relationship, and duping them into making investments into fake cryptocurrency projects... The scammer will eventually highlight seemingly impressive monetary gains from initial investments and encourage the victim to invest increasingly larger amounts, ultimately resulting in financial ruin to the victim.”)

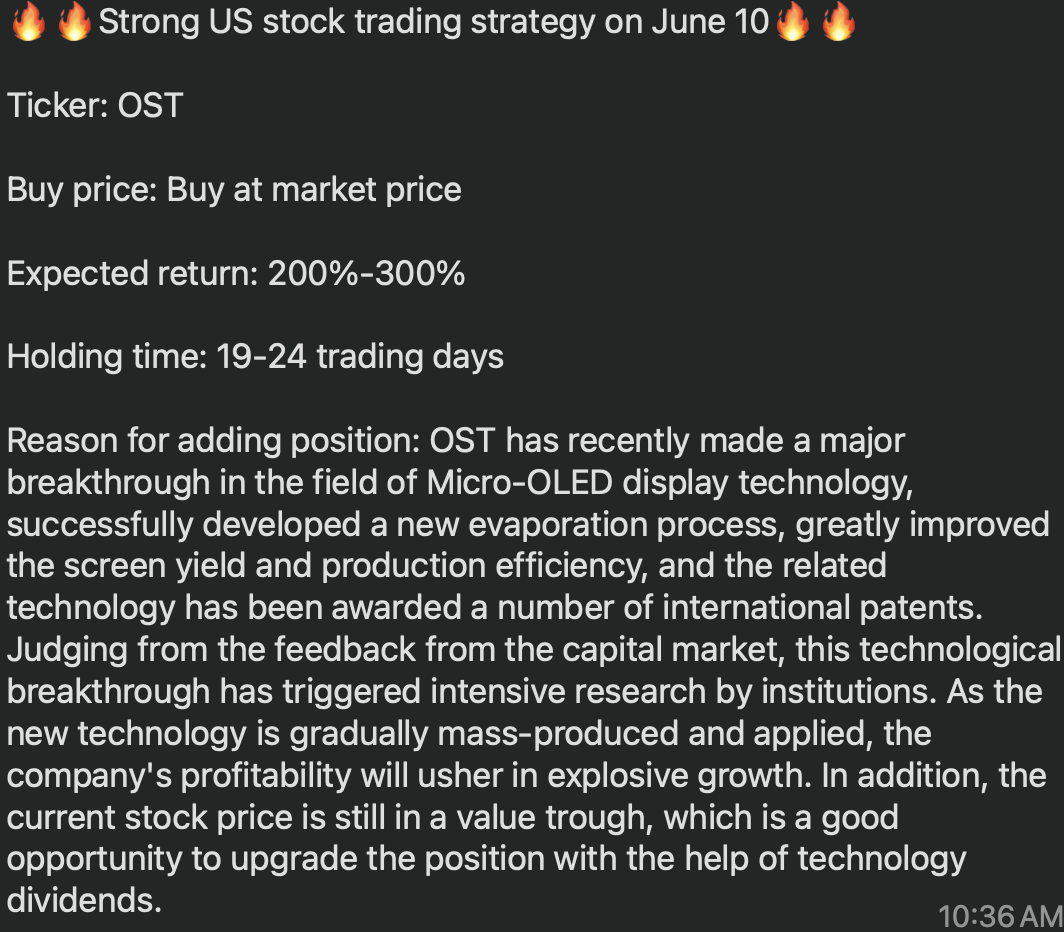

Among the come-ons my friend has received as a member of these groups...

And...

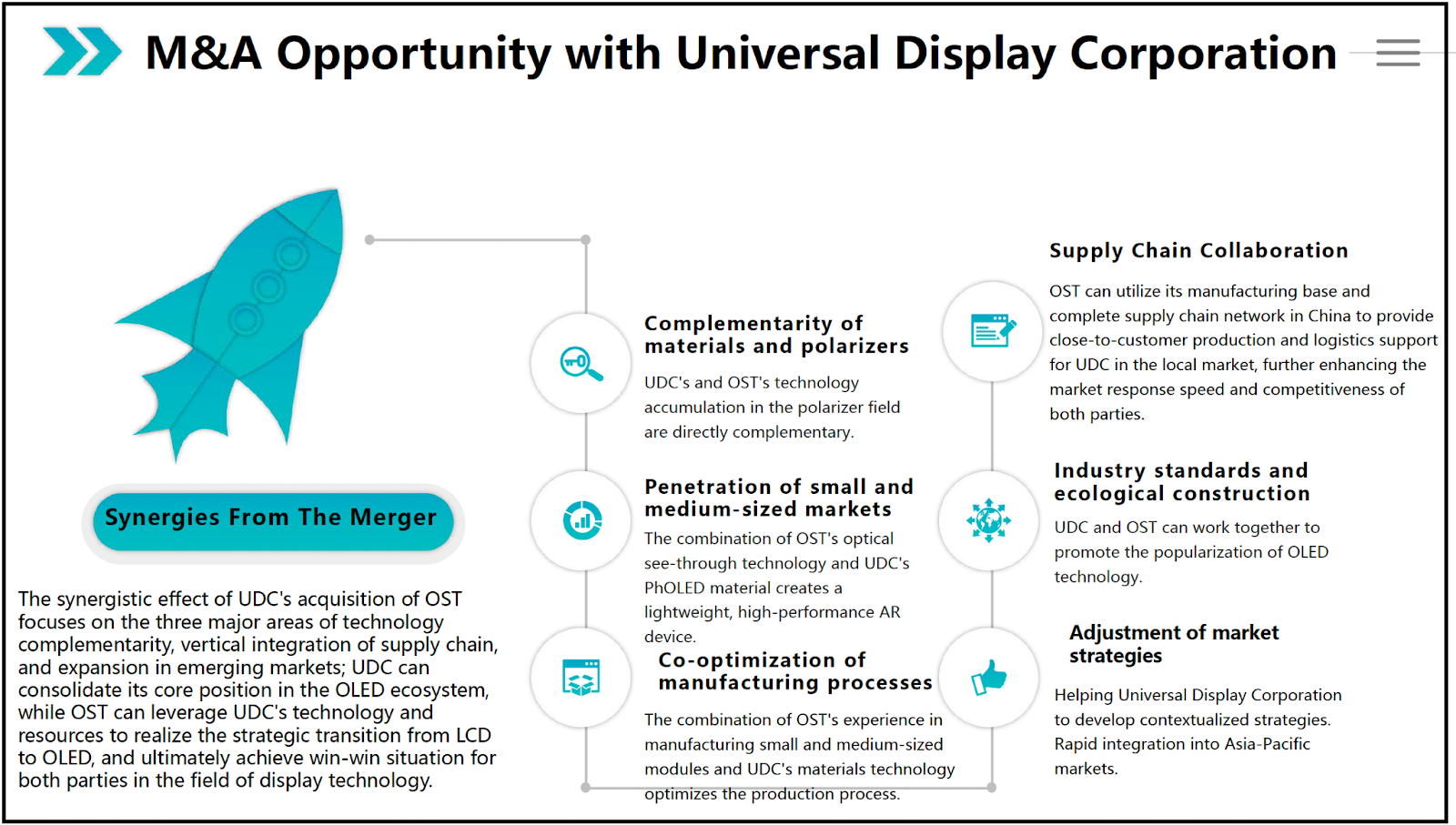

Then there’s the 20-page “medium Term Value Investment” research report making the rounds the other day, with “expected holding time remaining: 17-22 trading days.” It even includes a slide trying to promote reasons the company could be acquired by Universal Display ($OLED), an OLED leader....

That report was accompanied by a note that read...

Mr. McCabe has shared the latest OST research report today. Based on Mr. McCabe's in-depth analysis, we have further confirmed the strong trend of OST's business expansion. Its perfect planning not only lays a solid foundation for subsequent strategic formulation, but also provides a strong guarantee for future growth. From today, the stock will only need 17-22 trading days to hit the target price of $20-25, achieving an amazing profit return of 170%-250%. As the stock price continues to rise, every day is full of infinite expectations! Do you have a clear understanding of today's research content?

Paging Mr. McCabe!

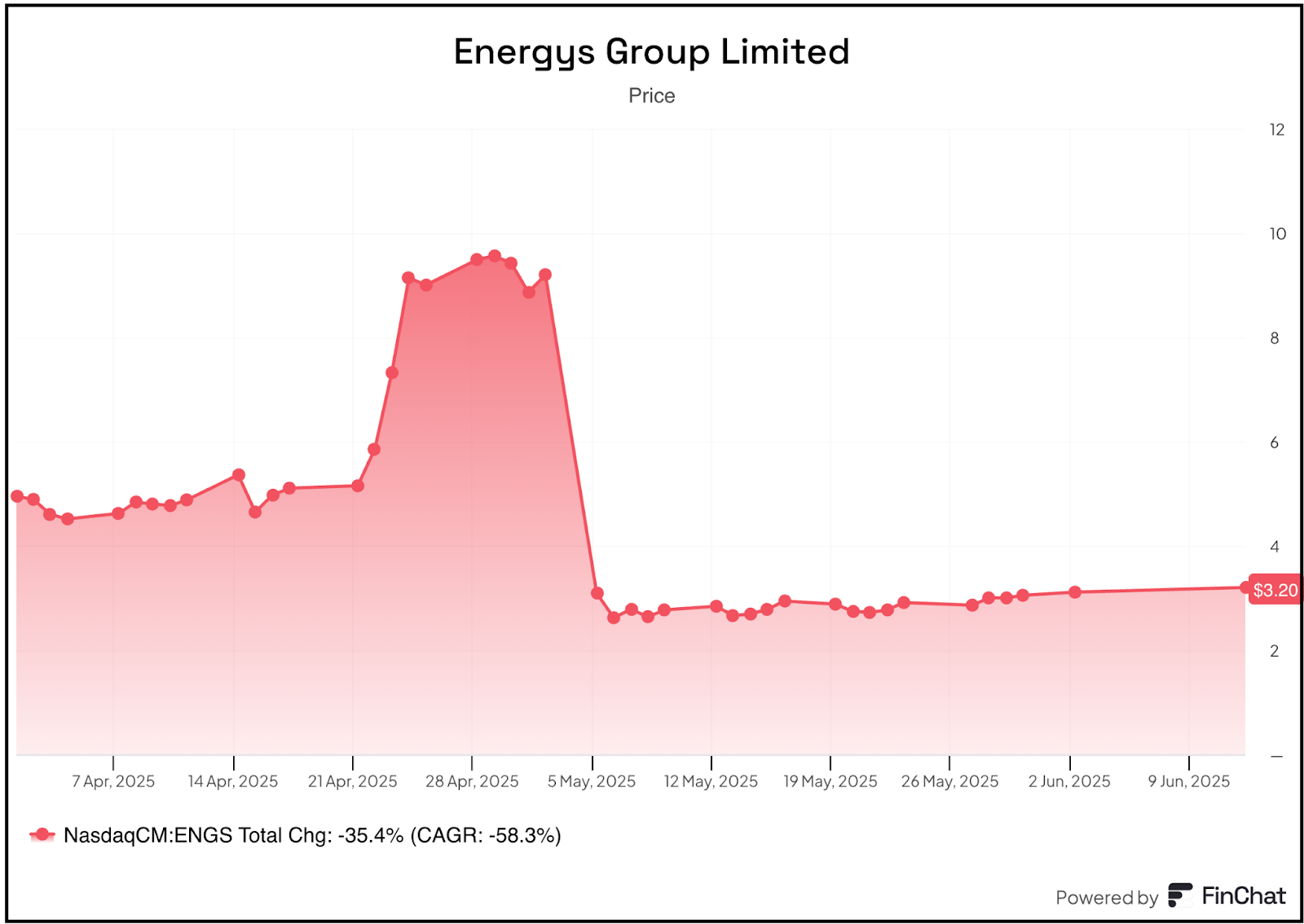

As it turns out, Ostin is just the latest in a series of these. For a preview of what might very well happen here, look no further than China-based Energys Group, which trades on the NasdaqCM...

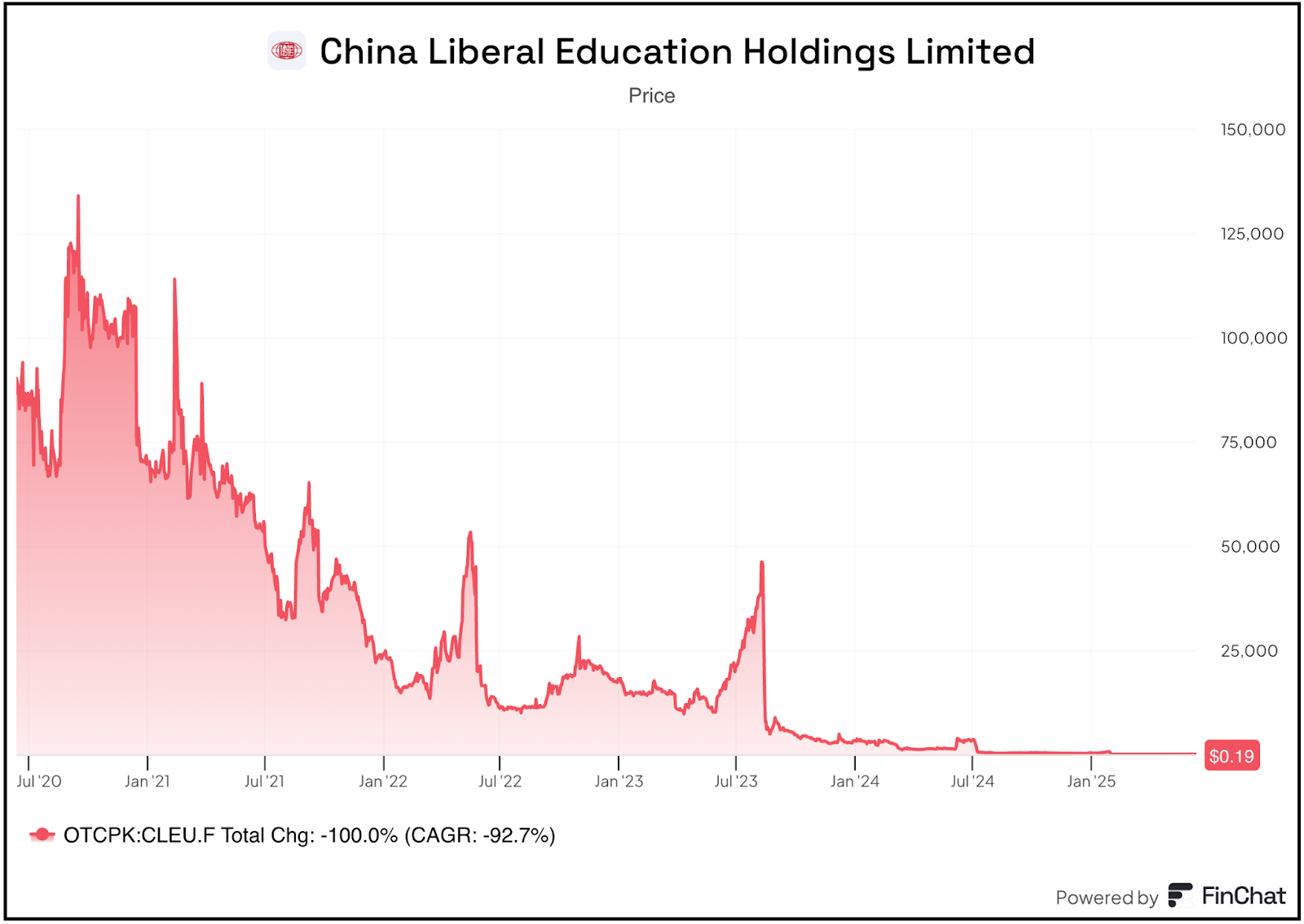

And China Liberal Education, which used to trade on the NasdaqCM, ran out of chits for more reverse mergers and was delisted. It now trades on the Pink Sheets.

Oh, how the deep fakes have fallen. Reason enough, for those of you who play in this pond, to keep an eye on Ostin.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I do not have a position in any stock mentioned here.

Feel free to contact me at herb@herbgreenberg.com