After watching a few Red Flag Alerts Focus List stocks rip yesterday, I posted on social media...

Ditto trying to reason with a crazy person.

Ditto trying to reason with a crazy person.

Or... you pick the metaphor.

What I know about companies on my Focus List is that they’re there for a reason – because, in theory, they’re riskier than other stocks. I’m agnostic about what people do with my information. Go long ‘em. Go short ‘em. I don’t care. We’re in a market where everybody’s got an angle. Some use fundamentals. Some use charts. Some use both. Some use neither... and just go on gut.

To which I say: whatever works.

But in the end, the fundamentals win out.

Squeeze the Shorts?

Sure. Just remember there’s a whole body of academic work that shows heavily shorted stocks have a history of significantly underperforming even more than lightly shorted stocks, since (for better or worse) shorts often pile into the same ideas for the simple reason: Where there’s smoke...! Not always, but often.

Squeezes are nothing new, but thanks to changes in market structure, with social media as added fuel, they appear to be more violent and extreme.

But in the end, as I often say: Have fun taking the express elevator up because, with the cushion of natural buying by short-sellers gone, there’s a high probability it will be an empty elevator shaft down.

I feel so strongly about this that I’m seriously pondering running a list of short-squeeze candidates, except relabeling them as Today’s Most Dangerous Stocks. (Let me know what you think!)

Enter Hims...

Yesterday was one of those whack-o (more like Whack-A-Mole) days.

Right out of the gate it was Hims & Hers, spiking nearly 10% and finishing the day up 18% for no logical reason other than a high short interest-sparked squeeze-o-rama.

It certainly wasn’t because of near-term guidance, which was disappointing – and which caused the stock to slump in post- and pre-market trading after reporting results.

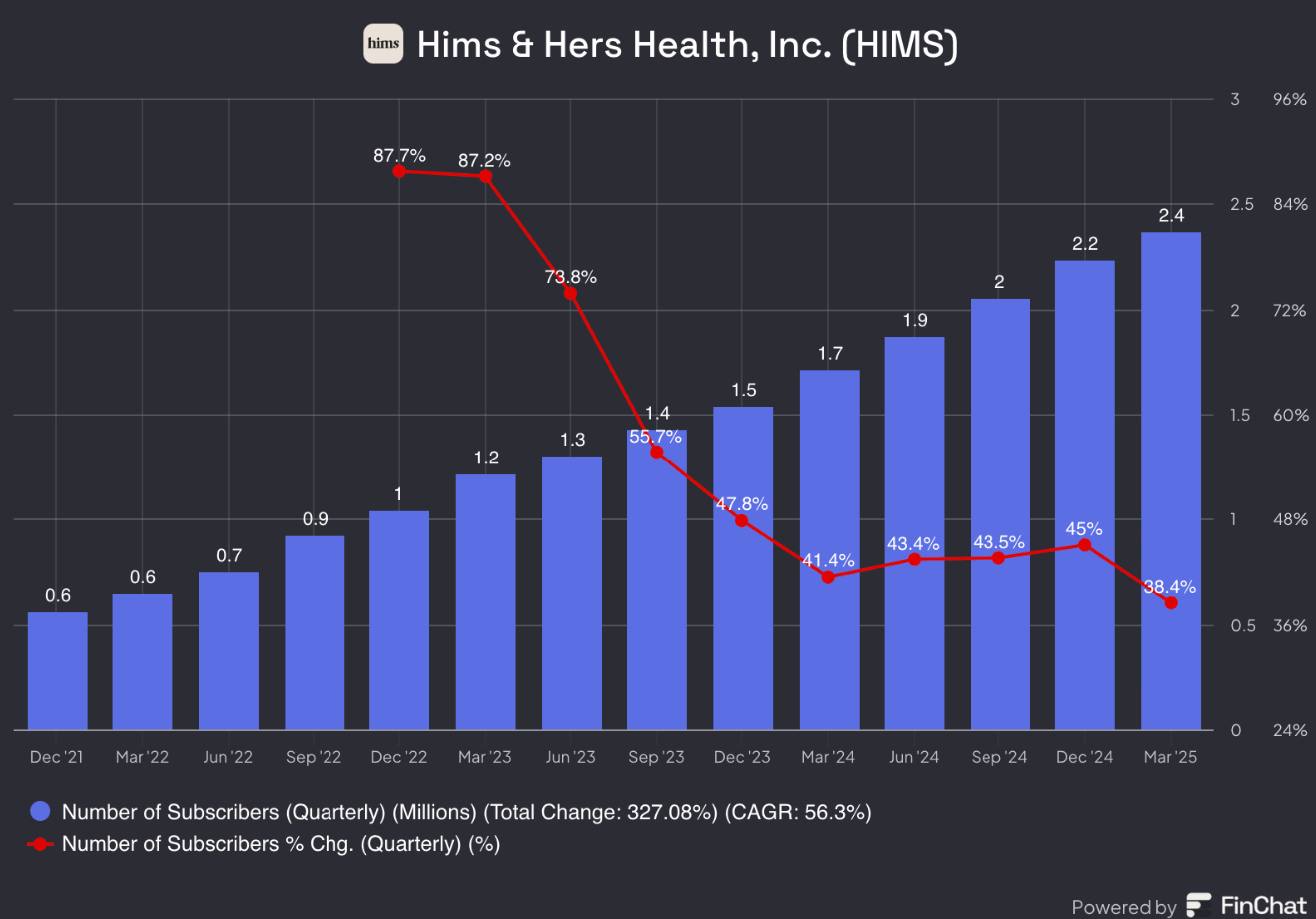

And it wasn’t because of subscriber growth...

And it wasn’t because of the recent non-exclusive deal Hims struck with Novo Nordisk to sell its branded Wegovy GLP-1 drug.

And it wasn’t because of its core non-GLP-1 business, whose growth is decelerating.

And it certainly wasn’t because of its long-term guidance, which in this case was five years. Five years... really? Actually, in this market, sure – why not?

(By the way, if you want a seriously cogent level-headed, currently bearish view on Hims, I highly urge you to subscribe to Paul Cerro’s Cedar Grove Capital Management. He’s a former Hims bull, and a former employee at Hims rival, Ro – which, oh by the way, sells Wegovy for $100 less than Hims. As does Novo.)

Then There’s Oklo...

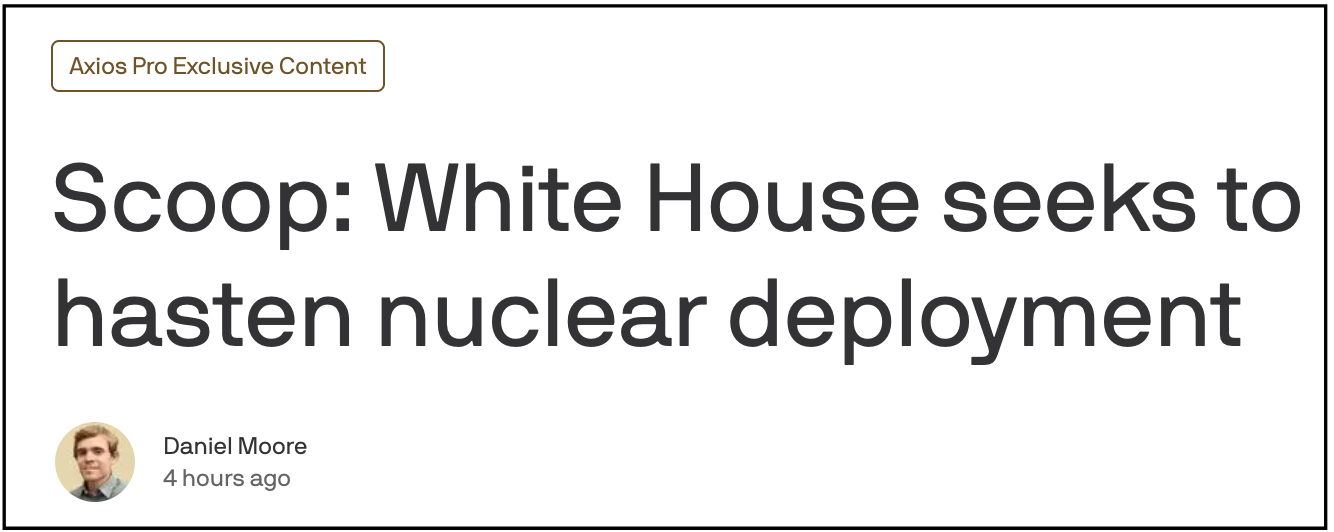

This small nuclear reactor wannabe, formally red-flagged in March, spiraled higher just before the close on a headline in a paywalled Axios piece that said...

The story itself, about possible “executive action,” didn’t mention Oklo or any other company. But the reality is that there are plenty others that are better-financed competitors with a high likelihood of early success, but which happen to be private. They include Google-backed Kairos, Amazon-backed X-Energy, Cameco/Brookfield-owned Westinghouse, Bill Gates-backed TerraPower and even Andreessen Horowitz-backed micro-reactor maker, Radiant – the venture firm’s only current nuclear investment.

That last point, about these being private, is an important one: Those with possibly the best potential, it seems, are being kept behind the paywall as long as possible. Or as is the case of Westinghouse – was bought in a strategic deal.

Let that sink in...

P.S.: Oklo, of course, isn’t the only possibly toxic nuclear name. For more, check out my “Nuclear Gone Wild” and “Atomic Frenzy” reports from October.

Now, Onto Otter Tail

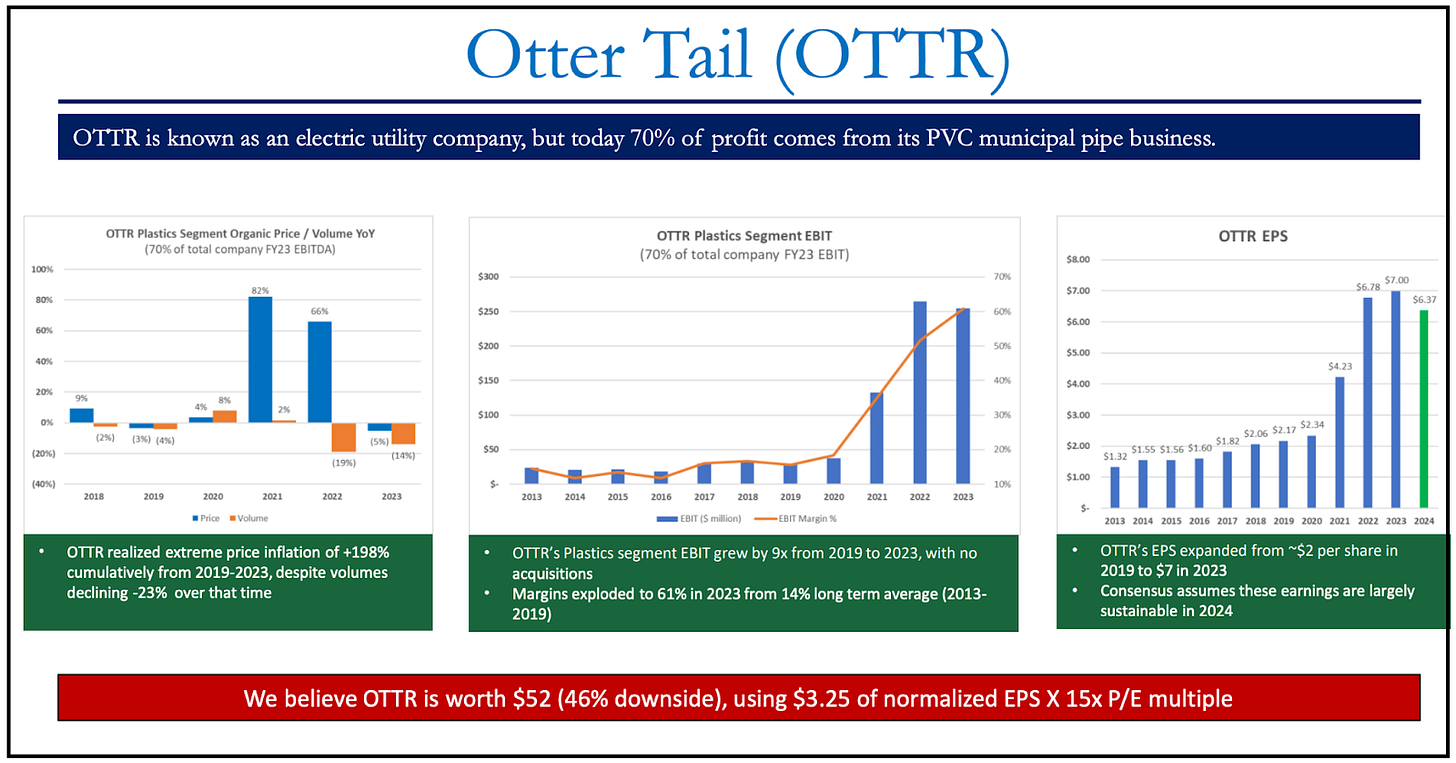

One Focus List stock that isn’t being squeezed higher is Otter Tail, the Minnesota utility seemingly on nobody’s radar, but should be.

On the surface, certainly to computer algorithms, it has looked like an over-earning utility – almost too good to be true. That’s because... it is! (Too good to be true, that is!) As I explained in my original reportlast August, it has been riding a post-Covid wave of a sharp increase in demand for its non-utility PVC piping business – a.k.a. “Plastics” – which generates 30% of revenue but an astounding 70% of profits, with equally robust gross profit margins, to match.

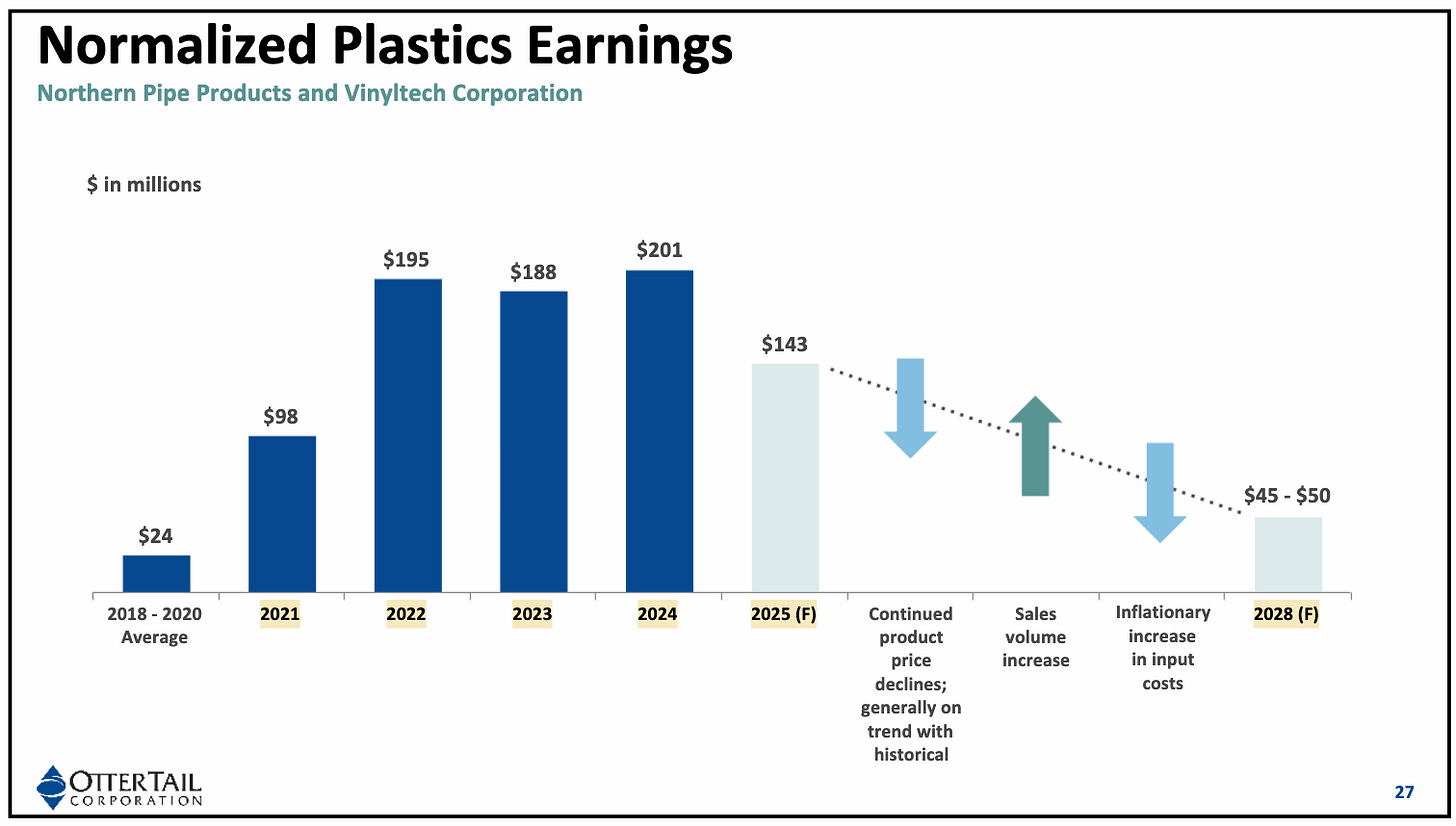

It’s supposed to be the other way around – and it looks like it’s on its way there – something the company has been warning about quarter after quarter on earnings calls and in its earnings presentation. This slide, from the most recent earnings, can’t be any clearer...

It’s like they’re putting it in big, bold, neon lights!

What’s more, management said that the gross margin for Plastics, which peaked at higher than 60%, is headed back to “pre-2021” levels. That means more like the mid-to-high teens.

A big part of that is a rapid drop in pricing. No surprise, since Otter Tail is being investigated by the DOJ as part of a PVC price-fixing probe.

The stock is currently (as I write this) at around $75 – or 15% below where I first red-flagged it. How low could I go?

Well, an anonymous short-seller who first flagged price-fixing problems at Otter Tail and a few others last summer – my source for the idea and whose forecasts on this have been eerily right – included this slide in his original report…

If he’s right, with earnings last year at $7 per share, that means another 31% to go.

Interpret at will.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) I have no position in any stock mentioned here. I’m under no obligation to update or alert subscribers if an when I make changes to any of my holdings.

Feel free to contact me at herb@herbgreenberg.com.