(If you’re not yet a full subscriber to On the Street, and wonder why you should subscribe, this post is for you. My prices for new subscribers will be going up on January 1 to $300 per year or $50 per month.)

The single biggest mistake investors make is looking at reward before risk. The smartest investors do just the opposite…

Looking for reasons to avoid buying a stock, or what the risks are if you do, has been the hallmark of Herb on the Street for decades and, in more recent years, my Red Flag Alerts.

It’s why, if you’re serious about investing, you should consider becoming a premium subscriber.

If you don’t think you can either make or avoid losing the price of the subscription – currently $250 per year and $35 per month, but rising to $300 per year and $50 per month on January 1 – then you should not subscribe.

Unless, of course, you’re here because you find some other value in my work, such as learning about how to avoid getting hoodwinked.

Whether I’m helping open your eyes to what could go wrong, or just flagging what ultimately may turn out to be an irrelevant piece of the mosaic, I like to think that I’m helping you manage or merely identify risk.

Or if you’re not an active investor, helping educate you about why some people might be on the opposite side of your trade. I can’t stress the importance of this!

Whichever camp you might fall in, as I explain in my introduction to the Red Flag Alerts, which includes samples, the concept is simple: with thousands of publicly traded stocks, why pick these?

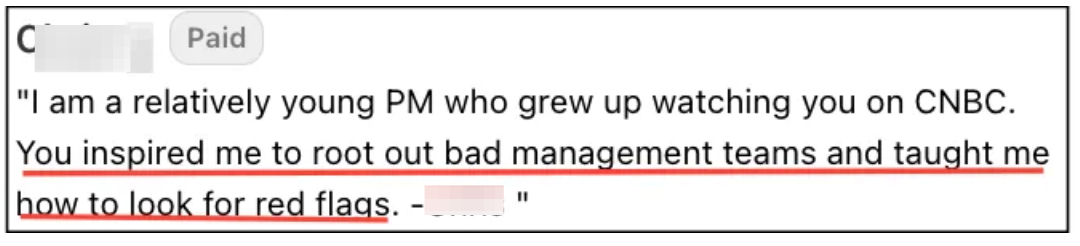

Even if I don’t write about your stock: in a market where the notions that “you only live once” and “hold on for dear life” have eclipsed the concepts of fundamental investing, hopefully Herb on the Street and my Red Flag Alerts will help serve as a reminder of the risks, as it did for this subscriber, who wrote…

P.S.: I once said I didn’t want to be the grumpiest guy in the graveyard. So for the record: I also raise a few generally “off the radar” green flags as well, such as AppLovin APP -3.97%↓, before it rose nearly 500%; Danaher DHR 0.09%↑ and Triumph Financial TFIN -1.15%↓.

But I practice what I preach – always thinking to myself: What could go wrong?

Hopefully after subscribing, you’ll be thinking that, too.

Cheers,

Herb

For more on Herb on the Street and my Red Flag Alerts, I urge you to read the “About” section of my newsletter, which spells out what you can expect and answers most if not all of your questions.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!) As of this date, I have long positions in Danaher and Triumph.

I can be reached at herb@herbgreenberg.com.