I can’t tell you the number of times I thought about buying Intel for the very reason... it’s Intel. It has to come back.

And then I realized... no, it doesn’t.

As one friend who has analyzed chip and tech companies for a very long time put it...

At one point there was a company that was a pure beneficiary from the internet adoption from PCs to servers, data centers, and wired cars.

Any hot area of growth and they were in. There was almost nothing in tech that could run without their products. It was effectively a monopoly. Massive margins, massive earnings. Their products did not increase computing power by 10 times but probably closer to 1million times over the years.

That company, of course, is Intel, arguably the most powerful force behind the original tech boom, elevating it to superstar status. Then-CEO Andy Grove was so revered that his 1996 book on Intel’s road to success, “Only the Paranoid Survive,” went on to become a best-seller... putting Intel on a golden pedestal as if it knew the true secret to everlasting success.

Truth is, no company and no CEO really does...

Luck and Timing

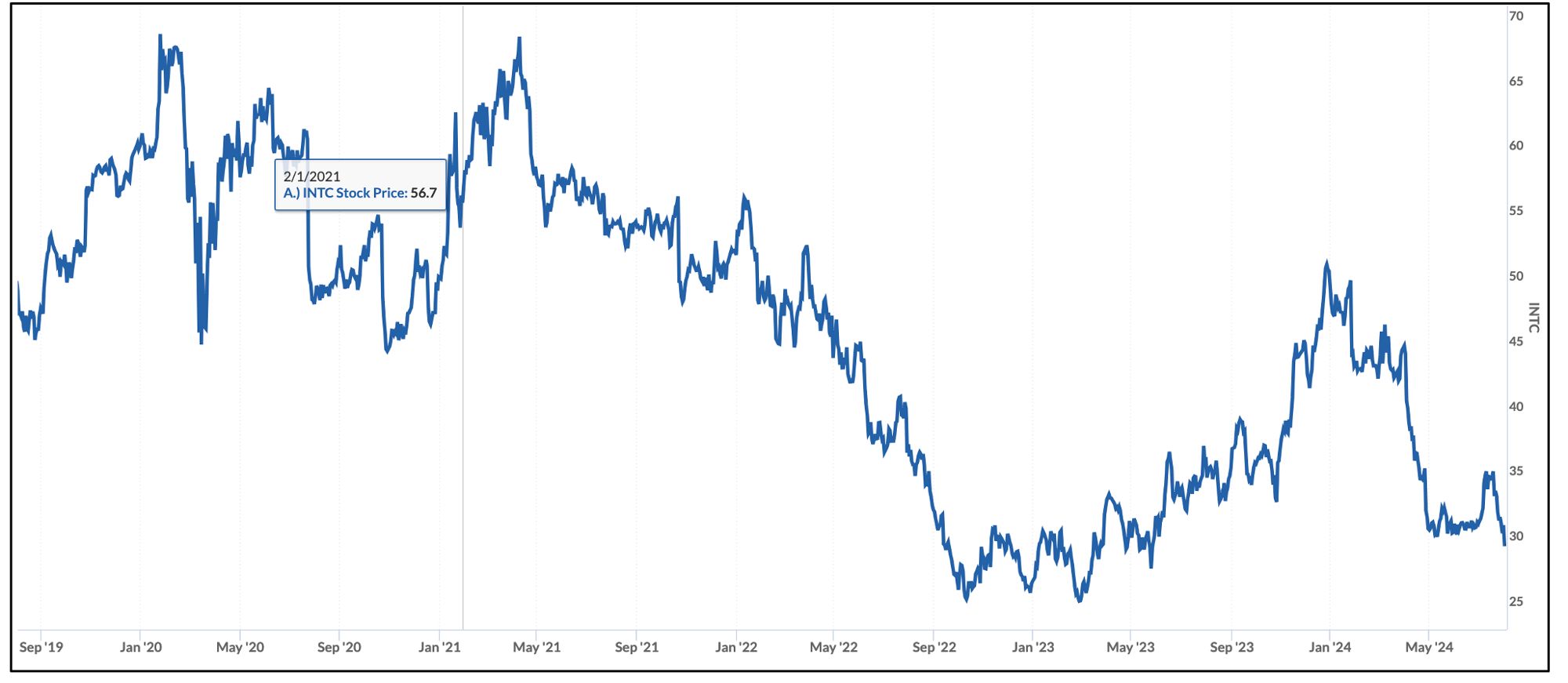

There’s no question the skill of management is critically important in execution, but so are luck and timing. The luck part ran out years ago, and the company’s fate was sealed when it hired former VMware CEO Pat Gelsinger as CEO in 2021.

He was the wrong guy at the wrong time... and the management diligence firm of Paragon Intel said as much in July of 2021 when it recommended shorting Intel because it hired Gelsinger.

After digging deeply into his personal and professional background, it pieced together a mosaic that said his hiring was reason to short the company’s stock. Or as the headline of its report put it...

Pedigreed semiconductor CEO will not prevent Intel’s declines.

Paragon, which operates the service ManagementTrack, went on to overlay everything it had learned about Gelsinger with the company’s fundamentals, before concluding...

At Intel, he will preside over continuing share losses to leading edge, foundry-backed competitors; declining datacenter margins as customers increasingly create their own ARM-based chips; and a decline in buyback-driven earnings growth as Intel ramps capital expenditures to close its competitive gap.

Paragon added...

Gelsinger will fall short in his attempts to rejuvenate Intel’s innovation engine, prevent market share losses, and protect margins in the face of secular technological trends and unrelenting competitive intensity.

Among the reasons it cited, after talking to seven former colleagues...

Gelsinger as an uncreative thinker, a weak team manager, and an ego-driven leader who casts himself as the smartest guy in the room.

I have to say, that’s a heckuva call. Since Gelsinger was hired, Intel has lost half its value.

And I suspect we’ll be hearing speculation pretty soon not about if but when he will leave.

Is the Mag 7 Next?

But there’s more to this story that goes beyond Intel and Gelsigner... and has everything to do with today, especially the seven gunslinger tech stocks including Apple $AAPL, Microsoft $MSFT Amazon $AMZN, Nvidia $NVDA and Tesla $TSLA – better known as the Mag 7, which are driving this market.

As my friend explained...

In tech they never can escape the same pattern. A tech company emerges as the market leader, it becomes the dominant player, and starts generating excess profits.

New tech emerges. To fight the new technology they have to compete again (means changing the culture) and be willing to sacrifice the profits, for which any CEO of a public company will get fired. It happens over and over and over.

Who do you think it will be?

I can be reached at herb@herbgreenberg.com.