The other day I wrote that the market is getting closer to that inflection point, and that it had gone from irrational and unhinged to...insane?

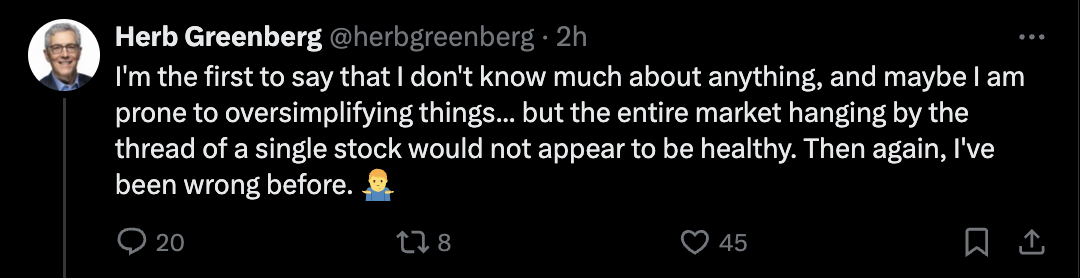

With the market seemingly relieved that Nvidia ($NVDA) didn’t somehow disappoint I took to the former Twitter to post...

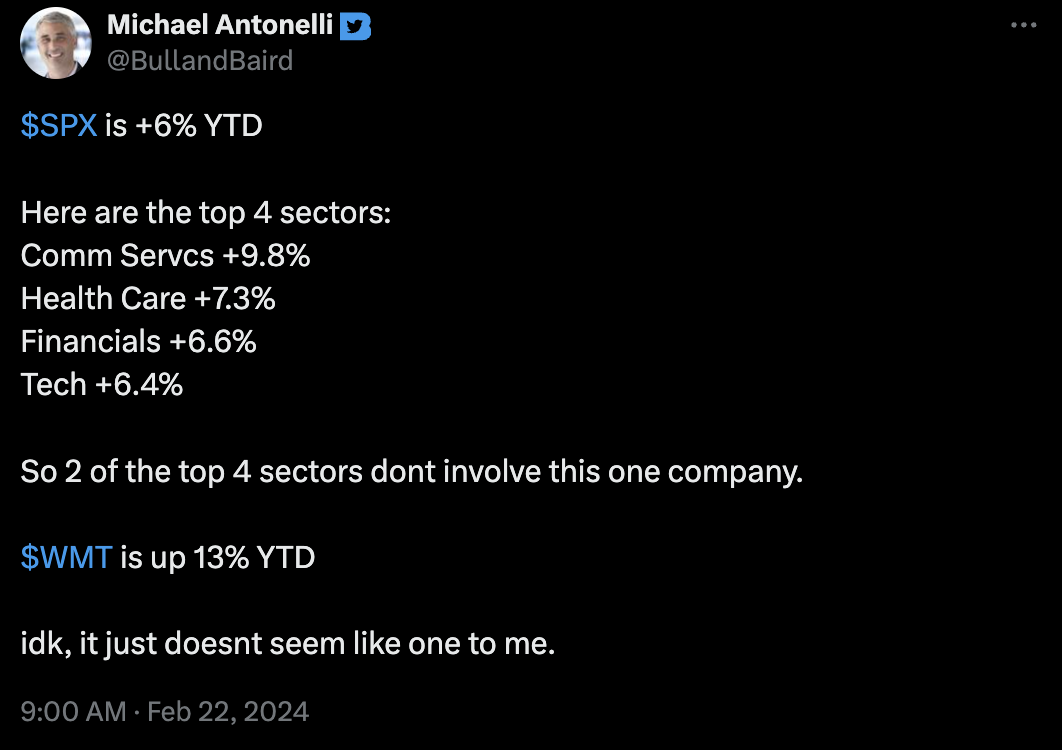

That prompted Michael Antonelli, chief strategist for R.W. Baird to respond...

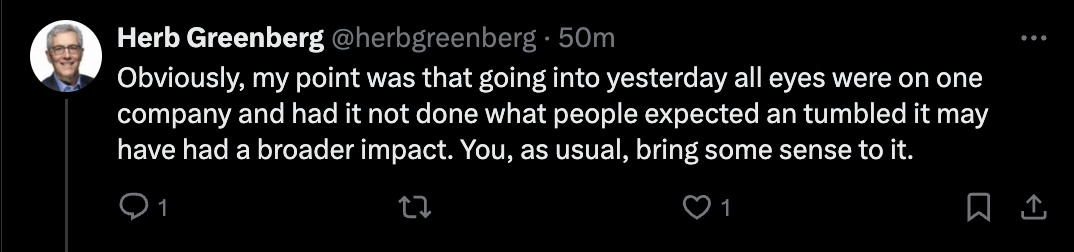

I responded...

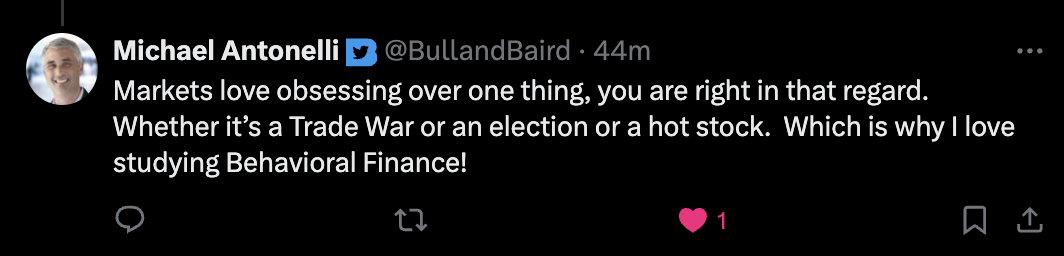

To which he responded...

Which is why unless you’re in this for the game of it, which is okay, it’s best to just invest in good companies with long-term opportunity and ride through the rough patches. It’s not as much fun, and probably has less immediate upside, but a more sane way to live.

The market is clearly about more than Nvidia...

Or the so-called “Mag 7”...

Or the latest and greatest.

As Tracy Ryniec, the value strategist at Zacks puts it...

All of this prompted my old friend Doug Kass to weigh in, suggesting I reread legendary market strategist Bob Farrell’s 10 Lessons of investing. You can read them here – and you should, especially if you think you’ve got this market figured out.

As I wrote back to Doug...

These are fantastic, Dougie. While every generation may indeed throw a hero up the pop charts, through it all, the simplicity of Bob's rules ... still rule! Doesn't have to be any more complicated than that.

The beat goes on…

If you liked this, please feel free to hit the heart button and share with your friends.

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herb@herbgreenberg.com. You can follow me on Twitter (X) and Threads @herbgreenberg.

Thanks for reading Herb Greenberg | On the Street! Subscribe for free to receive new posts and support my work.