This quick update on my comments from last week on the way medtech stocks have been pummeled by the success of the miracle weight loss drugs.

Since then, I continue to be fascinated by the trading in these stocks…

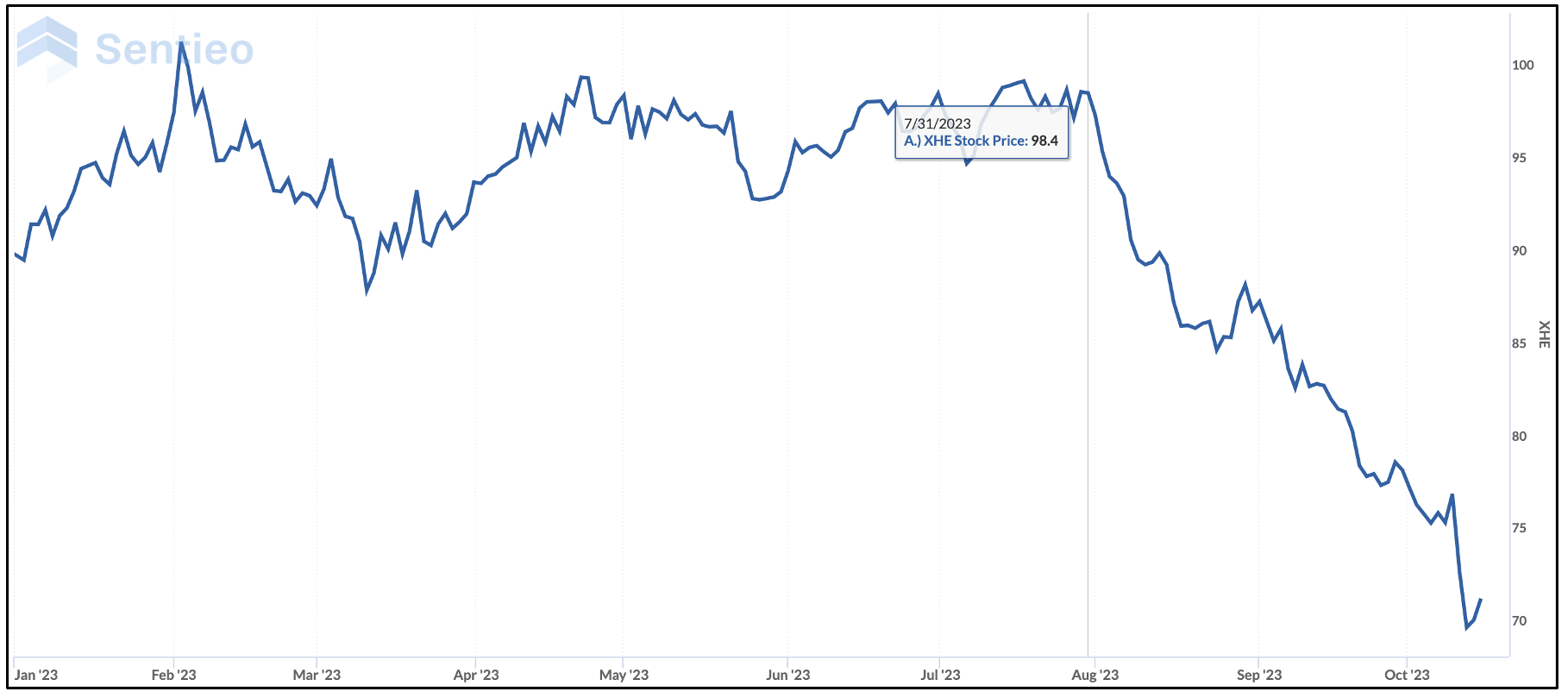

This chart, of the SPDR S&P Health Care Equipment ETF (XHE) says it all…

That falloff was just as both Novo Nordisk (NVO), maker of Ozempic, and Mounjaro maker Eli Lilly (LLY) were reporting headline-grabbing positive news about the impacts of their drugs…

Lilly had just reported that its drugs “demonstrated significant and superior weight loss” versus a placebo; a few days later Novo Nordisk dropped the biggest bombshell, announcing that its GLP-1 drug, as this class of drugs is known, “reduces the risk of major adverse a cardiovascular events by 20%” in overweight and obese adults in one of its trials.

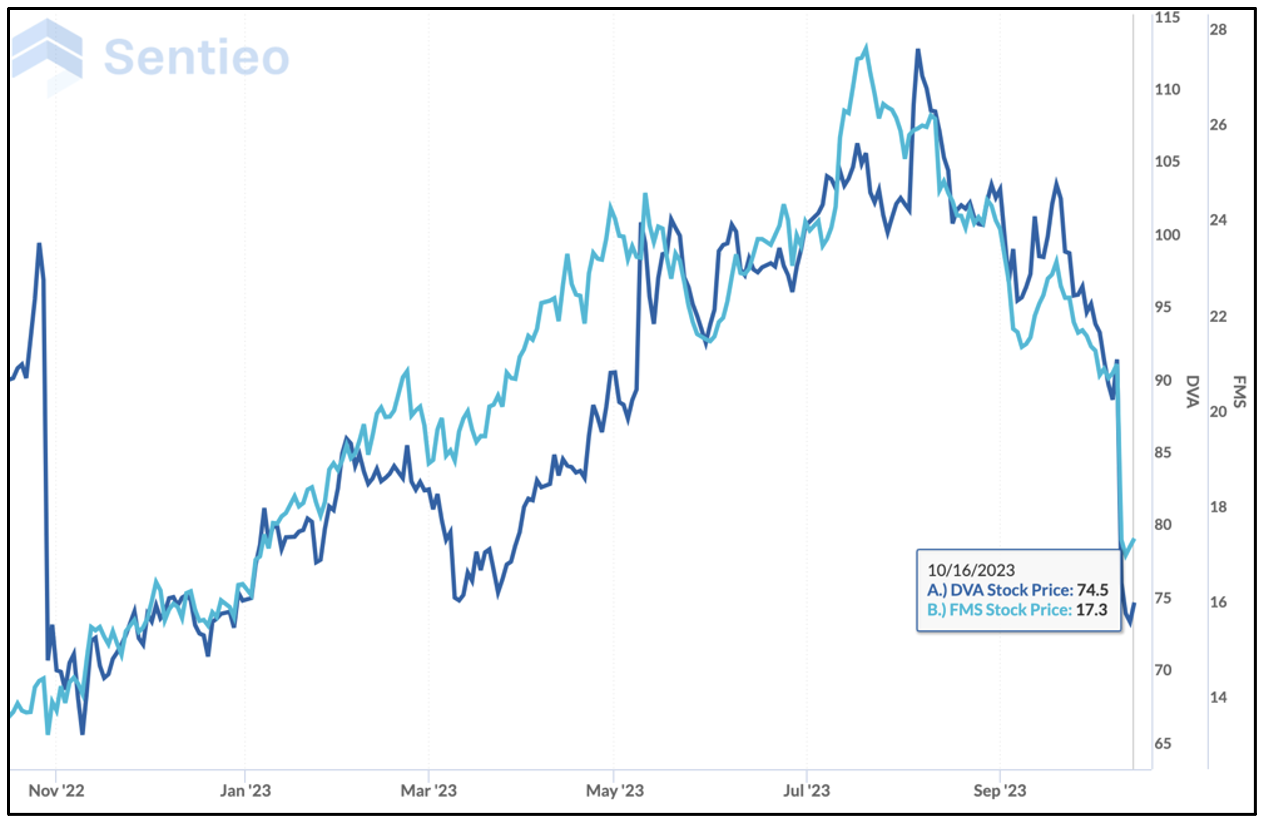

The latest to get slammed were kidney dialysis providers DaVita (DVA) and Fresenius (FMS)…

Both stocks are down roughly 20% since news hit that Ozempic has been proven to slow kidney disease.

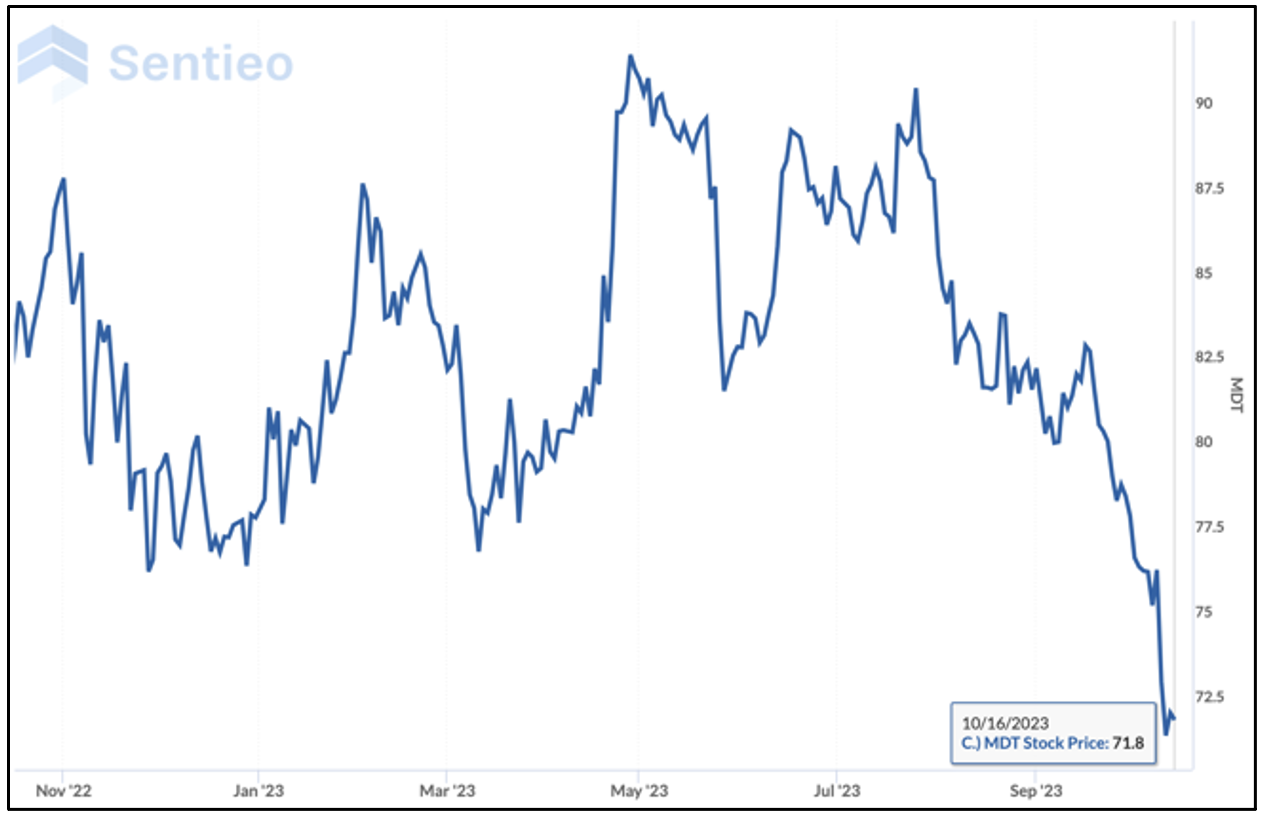

It’s similar to the hit Medtronic and other companies tied to cardiovascular disease were bludgeoned on the cardiovascular news.

The dilemma for investors is figuring out which of the most battered of these stocks are overdone...

Wall Street almost always leans hard into whatever the latest trend is. It’s doing the same this time, but instead of bidding stocks up, it’s slamming them down.

For some it may be deserved, because at some point less obesity could very well impact demand for their products....

For others, it was simply because they’re medtech.

What they all share in common is getting caught up in a narrative surrounding a disruptive technology.

Like it or not, narratives drive stocks. And hedge funds and other professional investors (magnified by the algos, no doubt) have quarterly returns to think about...

Central to that is whether these drugs are so potentially disruptive that the impact is genuinely structural... much the way Amazon upended retail. (That may be a bad analogy, but you get the point.)

Nobody can say with certainty, of course, but after chatting with friends at multiple funds three things seem to be going on...

They’re still trying to determine which companies are the most vulnerable.

They’re still trying figure out which ones may be impacted, but may very well shoot higher on even a sliver of good news, earnings or otherwise.

They’re trying to sort through the carnage to find companies that are highly unlikely to be hurt by these drugs, but whose stocks look as though they will be.

On that last point, analysts are already starting to come out with calls saying that selloffs in such companies are overdone…

They cite such companies as ResMed (RMD), which makes sleep apnea devices, and Dexcom (DXCM), known for continuous glucose monitors… and which I red flagged last August for other reasons,

On the kidney front, DaVita and Fresenius both offered up defenses, but they were somewhat different...

In a news release, DaVita said that while “it is nearly impossible to draw any conclusions” at this point, it believes the impact is likely to be limited. Fresenius told Reuters the result would be “neutral.”

In other words... they don’t really know.

In the meantime, the indiscriminate selling on the weight-loss craze is the reverse of indiscriminate buying in a bubble. And as an analyst from Jefferies wrote…

In the context of a set of new drug therapies that, while wonderful/game changing for many, are unlikely to change the growth opportunities for the vast majority of medtech in the long run.

Which gets to my reason for writing this…

Which stocks have been battered, but whose only sin is being medtech or, more broadly, healthcare?

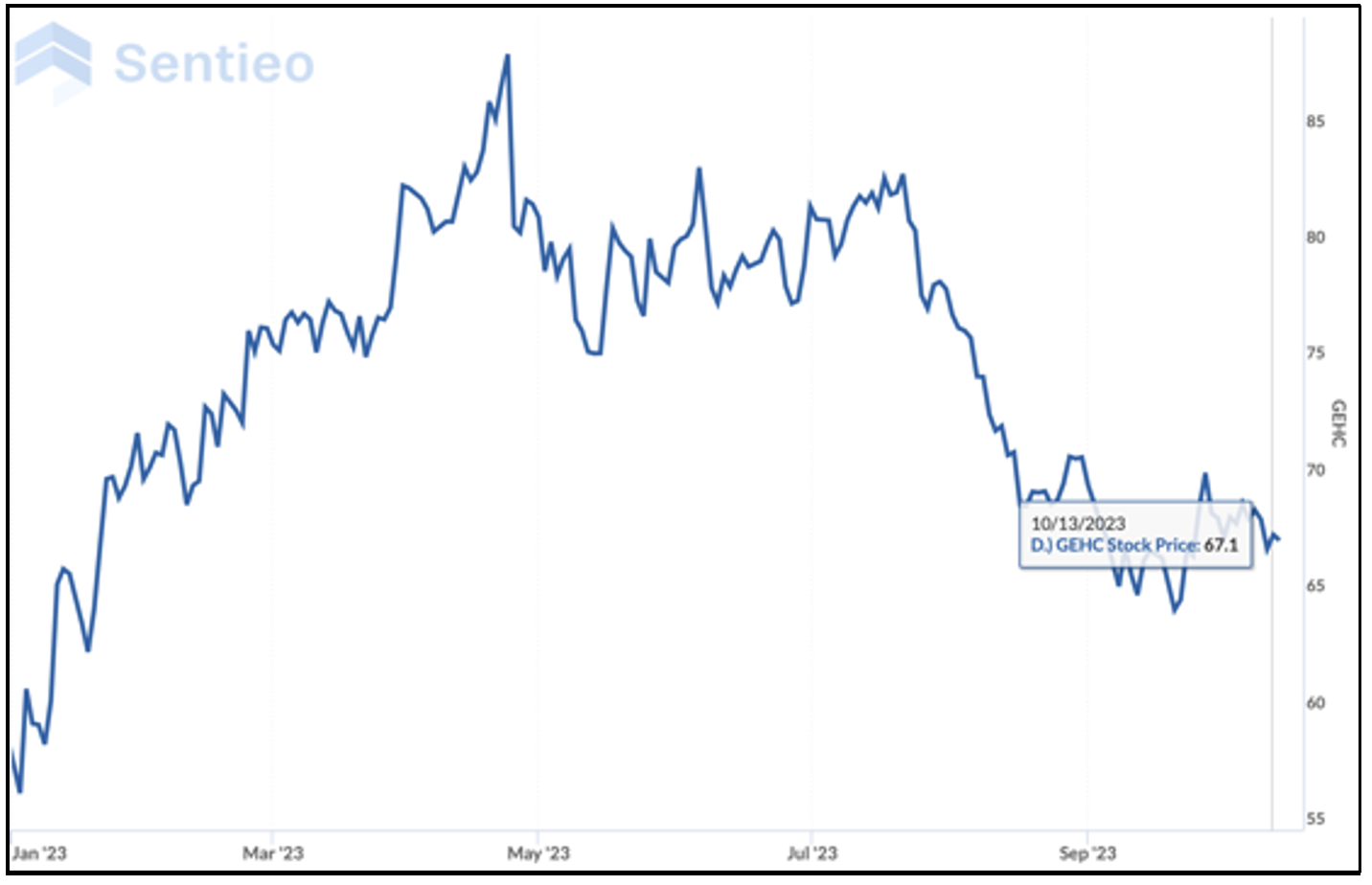

One good example would appear to be GE HealthCare (GEHC), the largest overall manufacture of imaging machines. More specifically, this spinoff from General Electric is...

One of the world's largest manufacturers of CT and MRI machines,

The largest maker of ultrasounds,

A leading manufacturer of various types of medical monitors, and

One of the largest producers of injectable contrast agents used in imaging.

If people are skinnier, will they get fewer images for certain health-related diseases and injuries likes knees and hips?

You would need to know what percentage of knee and hip replacements are due almost exclusively to obesity rather than aging and arthritis. I’m sure that data exists somewhere, but even assuming it’s close to accurate, I’m taking a wild guess here and saying natural wear and tear and aging play a far greater role. My multiple knee MRIs over the years were not because I was overweight – I wasn’t – but because I liked to run.

Along the same lines...

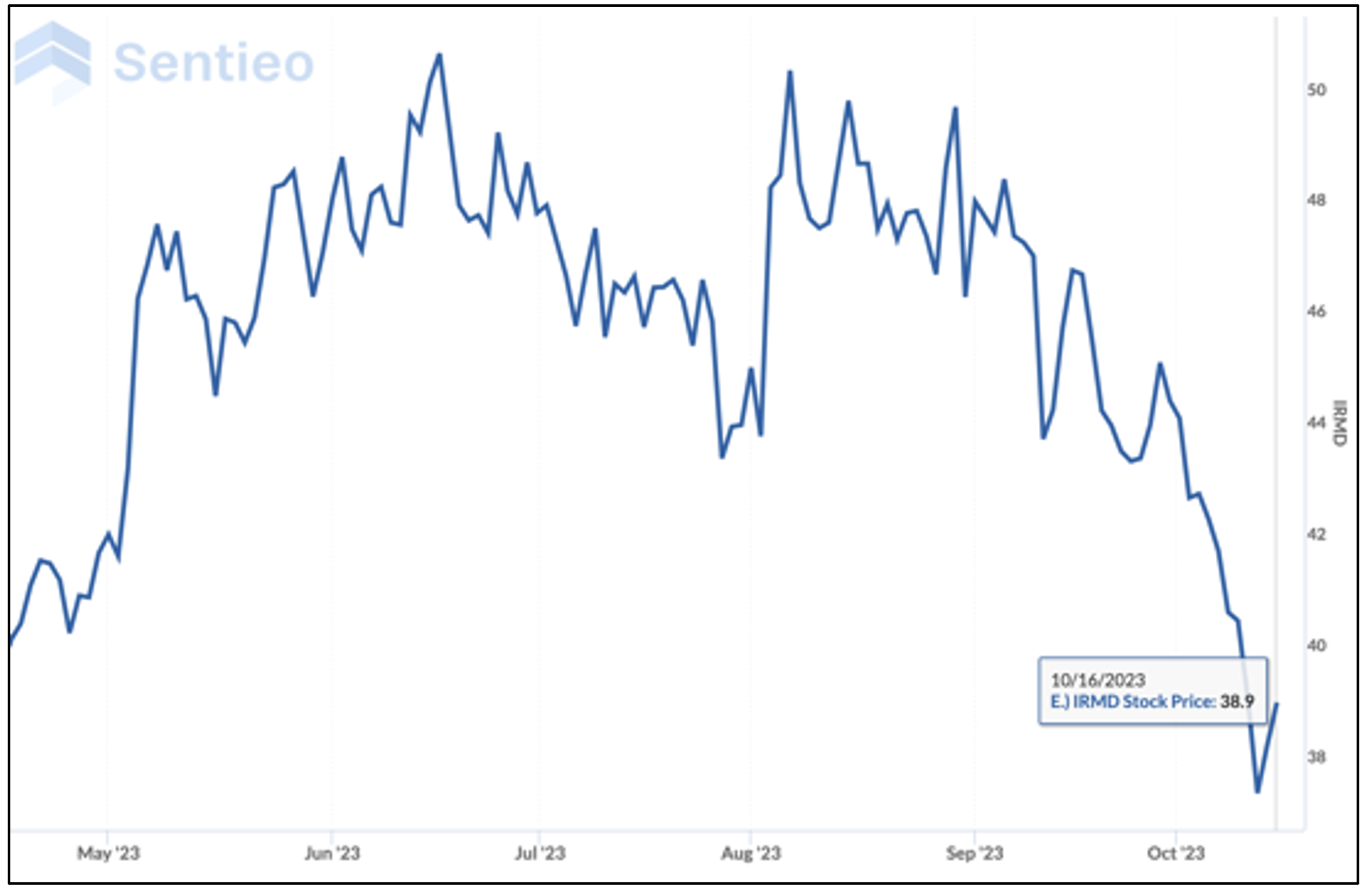

IRadimed (IRMD) is best known for infusion pumps that inject the imaging contrast into somebody getting an MRI. Seen its stock lately? On the valuation front, it’s not cheap, but it’s cheaper than it was before it got caught in the weight-loss crossfire.

The company’s entire business is tied to MRIs. Like GE Healthcare, it’s hard to see how a skinnier population would impact their future in a meaningful way.

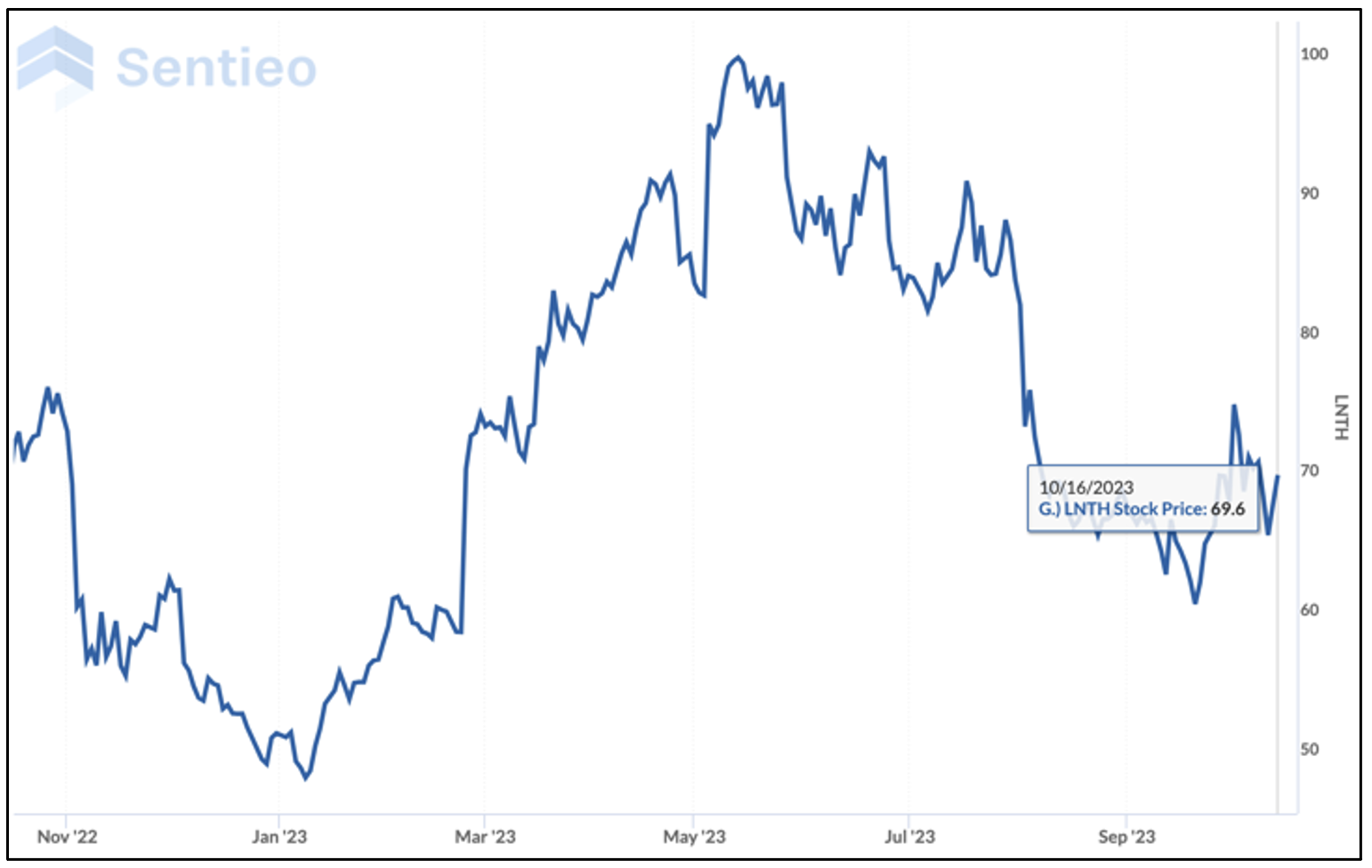

I also queried social media for names, and was tossed a few. One I had never heard of, but is worth mentioning: Lantheus Holdings (LNTH), which focuses on the emerging area of radiopharmaceuticals. These include imaging agents used in diagnosing such things as prostate cancer and heart disease.

I’m sure the mere mention of “heart” puts it in the penalty box, but that’s just part of its offerings… and last I looked heart disease is not going away anytime soon.

The company also currently has a licensing agreement with none other than GE HealthCare for one of its imaging agents, which is currently in Phase 3 trials.

These, of course, are just a few names. Have more? Feel free to add them to the comments below... or just email me but make sure you include your reasons why. If I get enough I may very well do a follow up.

One other thing: If you like this, that little heart below is there for a reason! ;-)

DISCLAIMER: This is solely my opinion based on my observations and interpretations of events, based on published facts and filings, and should not be construed as personal investment advice. (Because it isn’t!)

Feel free to contact me at herbgreenberg@substack.com. You can follow me on Twitter and Threads @herbgreenberg.

Thanks for reading Herb Greenberg | On the Street! Subscribe for free to receive new posts and support my work.